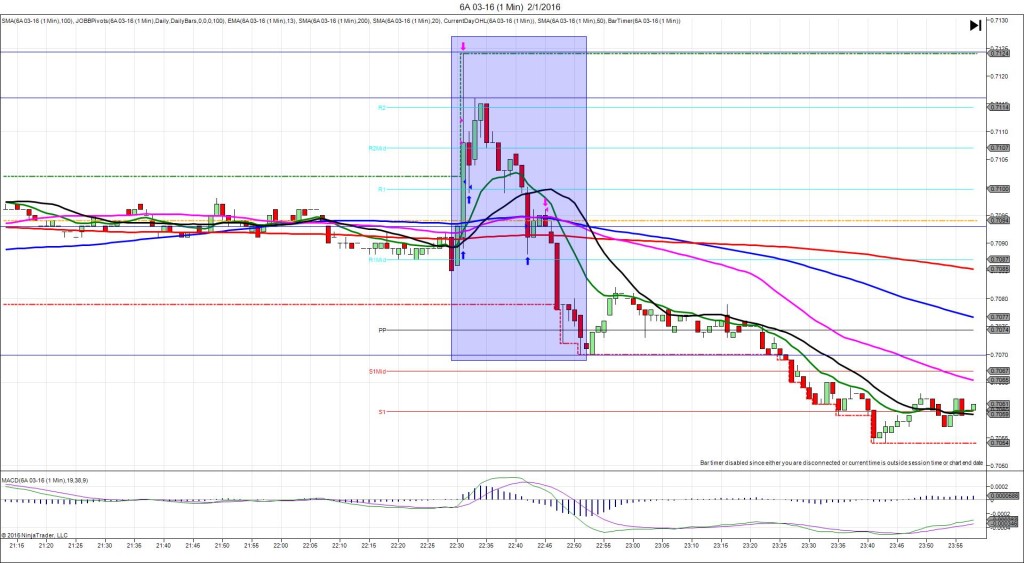

4/5/2016 RBA Rate Statement / Cash Rate (0030 EDT)

Forecast: 2.00% (no change)

Actual: 2.00% (no change)

TRAP TRADE – INNER TIER

Anchor point @ 0.7567

————

Trap Trade:

)))1st Peak @ 0.7546 – 0030:40 (1 min)

)))-21 ticks

)))Reversal to 0.7582 – 0031:43 (2 min)

)))36 ticks

————

Pullback to 0.7571 – 0033 (3 min)

11 ticks

Reversal to 0.7612 – 0035 (5 min)

41 ticks

Pullback to 0.7562 – 0112 (42 min)

50 ticks

Trap Trade Bracket setup:

Long entries – 0.7547 (just above the S2 Pivot) / 0.7533 (No SMA / Pivot near)

Short entries – 0.7587 (just above the HOD) / 0.7602 (just below the R1 Mid Pivot)

Expected Fill: n/a – 0.7547 – inner long tier

Best Initial Exit: 0.7581 – 34 ticks

Recommended Profit Target placement: 0.7567 (just above the S1 Pivot) and 0.7581 (just above the S1 Mid Pivot)

Notes: Perfect trap trade setup with the settings. An inner tier of 0.7547 or higher would have filled. If you set it for 0.7546 and saw a near miss, there was plenty of opportunity to manually move it up about 3 ticks for a fill. Then it reversed nicely to the S1 Mid Pivot and continued to step higher in the next 3 min to the R1 Pivot. After that it collapsed slowly over 37 min for 50 ticks to the 200 SMA.