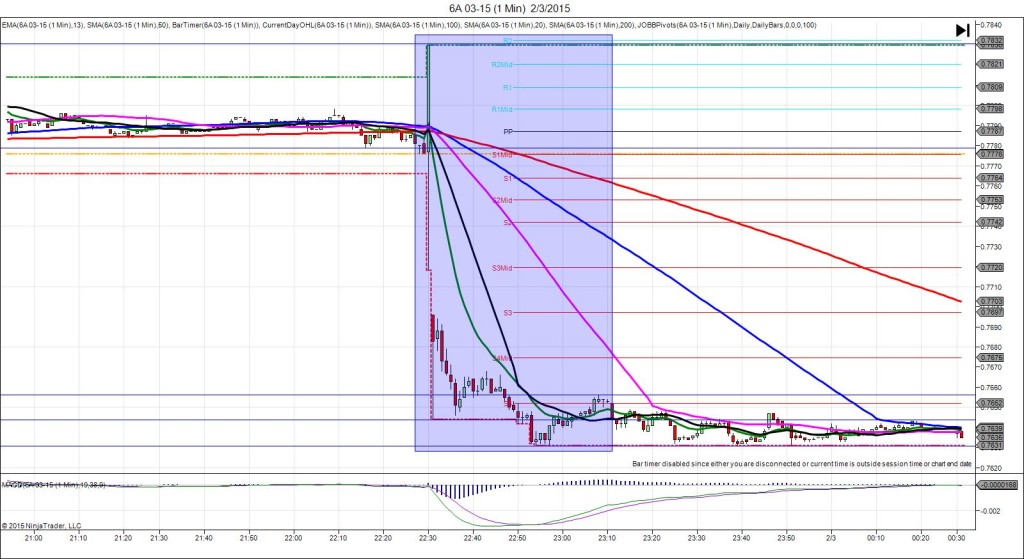

10/6/2014 RBA Rate Statement / Cash Rate (2330 EDT)

Forecast: 2.50%

Actual: 2.50%

TRAP TRADE – DULL NO FILL (SPIKE WITH 2ND PEAK)

Anchor point @ 0.8713 – shift to 0.8708 (on the PP Pivot)

————

Trap Trade:

)))1st Peak @ 0.8694 – 2330:26 (1 min)

)))-14 ticks

)))Reversal to 0.8703 – 2330:29 (1 min)

)))9 ticks

)))Pullback to 0.8691 – 2330:33 (1 min)

)))-12 ticks

)))Reversal to 0.8698 – 2331:00 (2 min)

)))7 ticks

————

2nd Peak @ 0.8682 – 2332 (2 min)

26 ticks

Reversal to 0.8712 – 2342 (12 min)

30 ticks

Pullback to 0.8696 – 2357 (27 min)

16 ticks

Reversal to 0.8710 – 0012 (42 min)

14 ticks

Trap Trade Bracket setup:

Long entries – 0.8695 (just below the PP Pivot) / 0.8685 (just below the S1 Mid Pivot)

Short entries – 0.8719 (just above the OOD) / 0.8729 (just above the R1 Pivot)

Notes: Australia’s central bank left rates unchanged as expected with no other major changed in policy. This caused a muted response that stayed within 4 ticks of the anchor point until 25 sec into the :31 bar. Cancel the order after 20 sec with no impulse. It eventually fell for a peak of 14 ticks to cross the PP Pivot, then stepped lower to eventually reach the S1 Mid Pivot for 26 ticks after 2 min. Then it reversed 30 ticks in 10 min to the R1 mid Pivot. If this reaction would have started immediately and panned out quicker, it would have been a good outer tier fill allowing for about 22 ticks on 2 contracts to be captured. Still be safe and cancel with the slow development.