9/1/2015 RBA Rate Statement / Cash Rate (0030 EDT)

Forecast: 2.00% (no change)

Actual: 2.00% (no change)

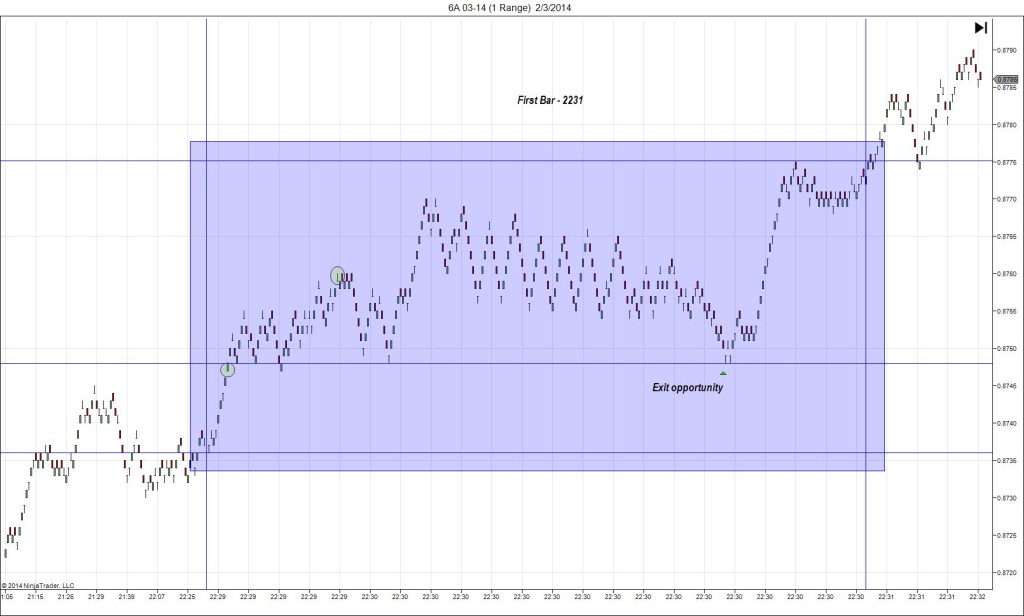

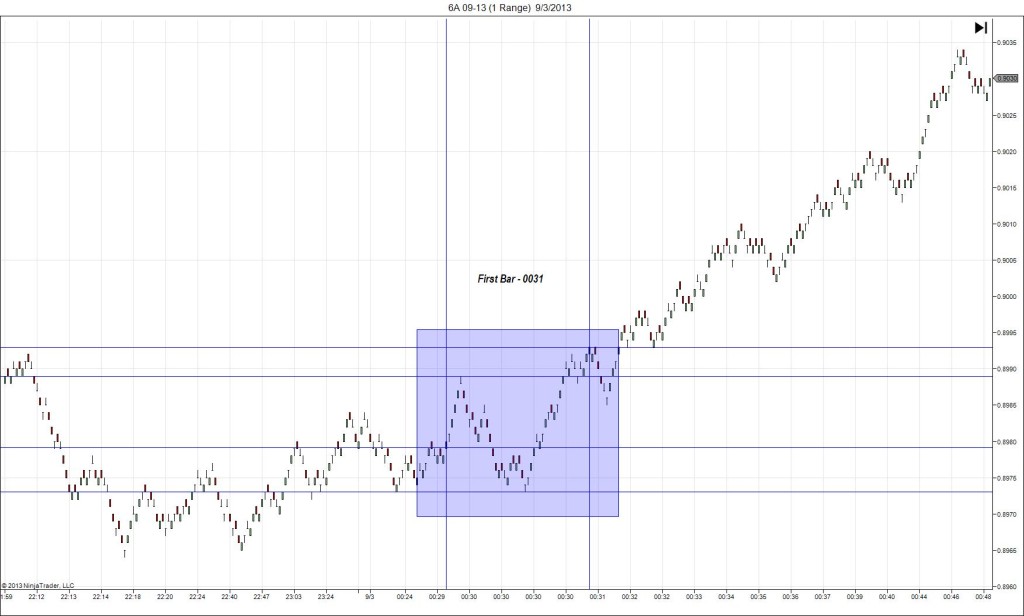

TRAP TRADE – INNER TIER

Anchor point @ 0.7129

————

Trap Trade:

)))1st Peak @ 0.7150 – 0030:23 (1 min)

)))21 ticks

)))Reversal to 0.7140 – 0031:04 (2 min)

)))-10 ticks

)))Pullback to 0.7150 – 0031:16 (2 min)

)))10 ticks

————

Reversal to 0.7130 – 0033 (3 min)

20 ticks

Pullback to 0.7148 – 0033 (3 min)

18 ticks

Reversal to 0.7116 – 0123 (53 min)

32 ticks

Trap Trade Bracket setup:

Long entries – 0.7108 (in between the PP Pivot / OOD) / 0.7096 (just below the S1 Mid Pivot / OOD)

Short entries – 0.7149 (in between the R2 / R2 Mid Pivots) / 0.7162 (No SMA / Pivot near)

Notes: The RBA made no major change in this cycle and is waiting to see when the FED will act to raise rates for the USD. This caused a 21 tick long spike in 23 sec that started on the 100 SMA and rose to cross the R2 Mid Pivot and extend the HOD. Then it reversed 10 ticks in 41 sec before pulling back for a double top. This would have filled the inner short tier as long as it was placed at 0.7150 or lower. Then is would have allowed for an exit with 5-9 ticks on the first reversal, or up to 17 ticks on the second reversal. The second reversal fell 20 ticks from the double top to the 100 SMA before pulling back 18 ticks. Then it reversed 32 ticks in 50 min after crossing the R1 Mid Pivot / 200 SMA.