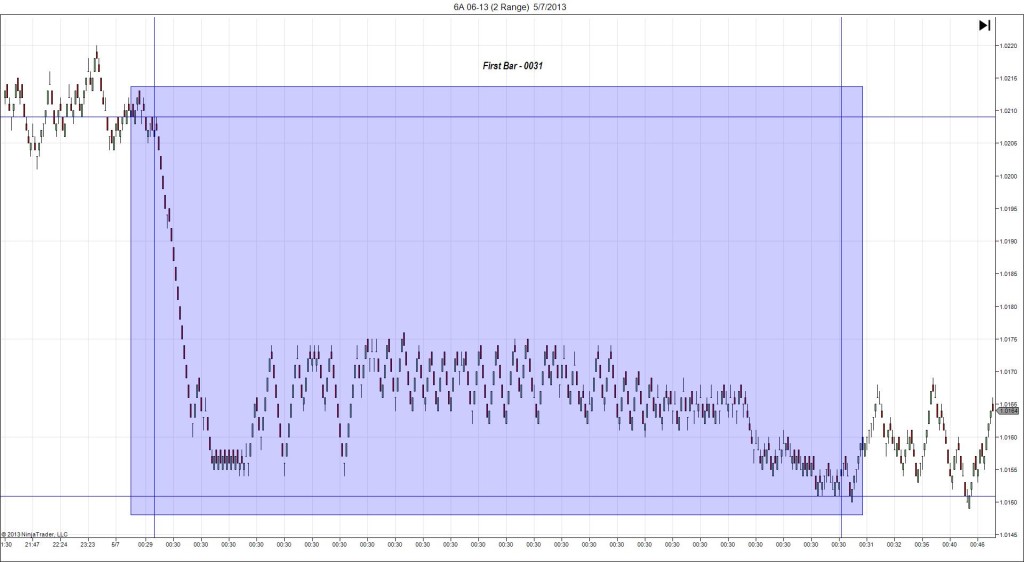

7/2/2013 RBA Rate Statement / Cash Rate (0030 EDT)

Forecast: 2.75%

Actual: 2.75%

TRAP TRADE

Started @ 0.9173

Trap Trade:

1st Peak @ 0.9187 – 0030:06 (1 min)

14 ticks

Reversal to 0.9159 – 0030:26 (1 min)

-28 ticks

Pullback to 0.9175 – 0030:52 (1 min)

16 ticks

Extended Reversal to 0.9108 – 0103 (33 min)

67 ticks

Pullback to 0.9131 – 0131 (61 min)

28 ticks

Notes: Australia’s central bank left interest rates unchanged as expected due to the surprise rate cut two months earlier, citing global growth running a bit below average this year, with reasonable prospects of a pick-up next year. Commodity prices have declined further but, overall, remain at high levels by historical standards. This caused a long move of 14 ticks followed by a 28 tick reversal, then a 16 tick pullback on the :31 bar. We recommended a trap trade with this report with a 20-25 tick offset. That would have been too large in this case as the 100 SMA or PP Pivot would have been a good anchor point around 0.9171. So anything over 15 ticks would not have filled. Cancel the order after 3 bars do not fill. After the initial indecision, the statement caused a bearish sentiment to prevail as it sold off for about 67 ticks in the next 30 min, eclipsing the S2 Mid Pivot, then it pulled back for 28 ticks in the next 30 min, crossing the 50 SMA.

-120312.jpg)

-120312.jpg)

-110512.jpg)

-110512.jpg)