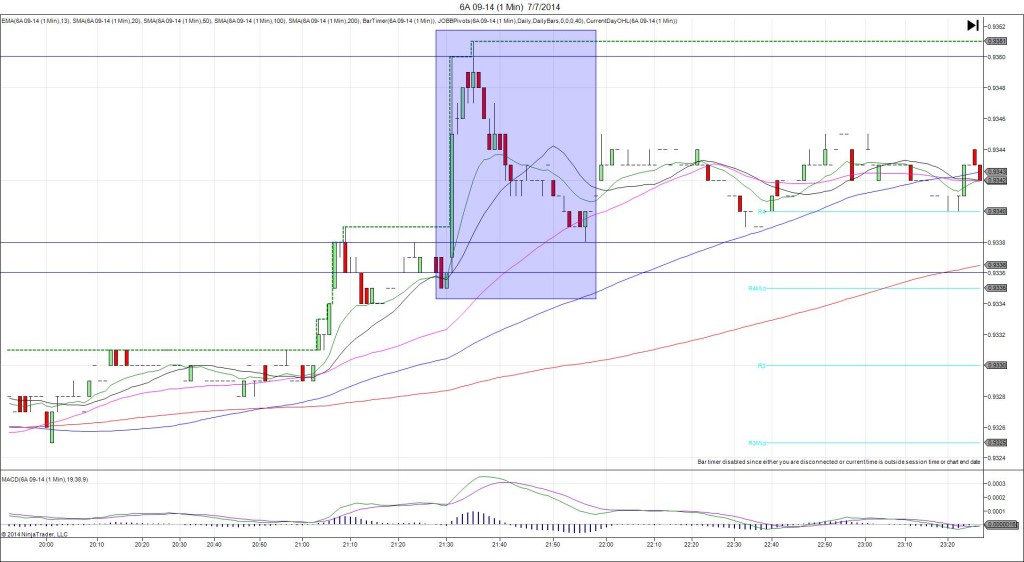

10/7/2013 NAB Business Confidence (2030 EDT)

Forecast: n/a

Actual: 12

SPIKE / REVERSE

Started @ 0.9395

1st Peak @ 0.9406 – 2032 (2 min)

11 ticks

Reversal to 0.9371 – 2136 (66 min)

35 ticks

Notes: Report came in at the highest level in recent months to cause a long spike of 11 ticks that started on the 13 SMA and was slow and tame to advance. It crossed the R1 Mid Pivot and extended the HOD, peaking 6 sec into the :32 bar. After the peak, it reversed slowly and methodically for 35 ticks in the next 64 min, crossing all 3 major SMAs, the S1 Mid Pivot, and extending the LOD. This could have also been correcting the bullish advance in the hour leading up to the trade.