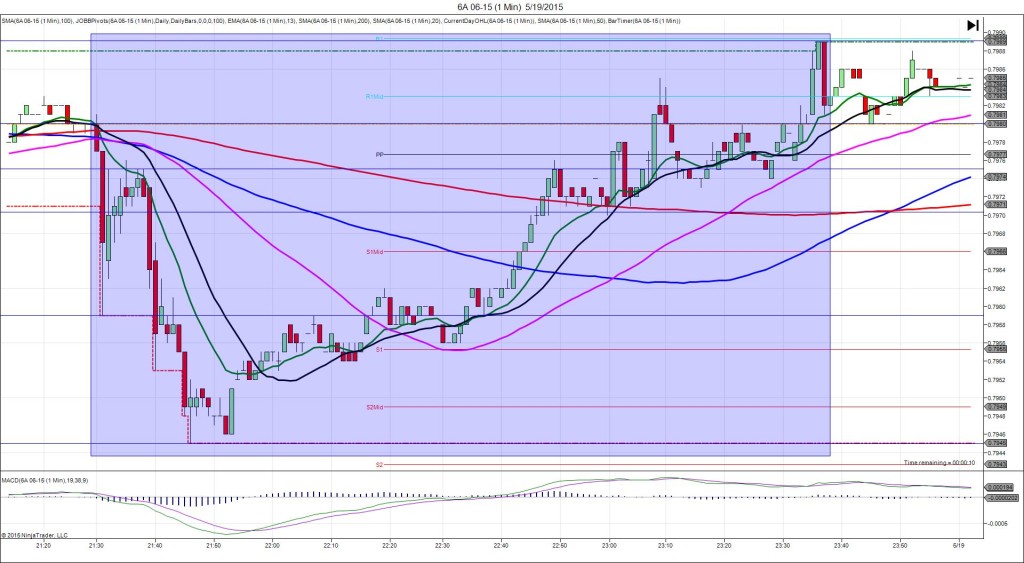

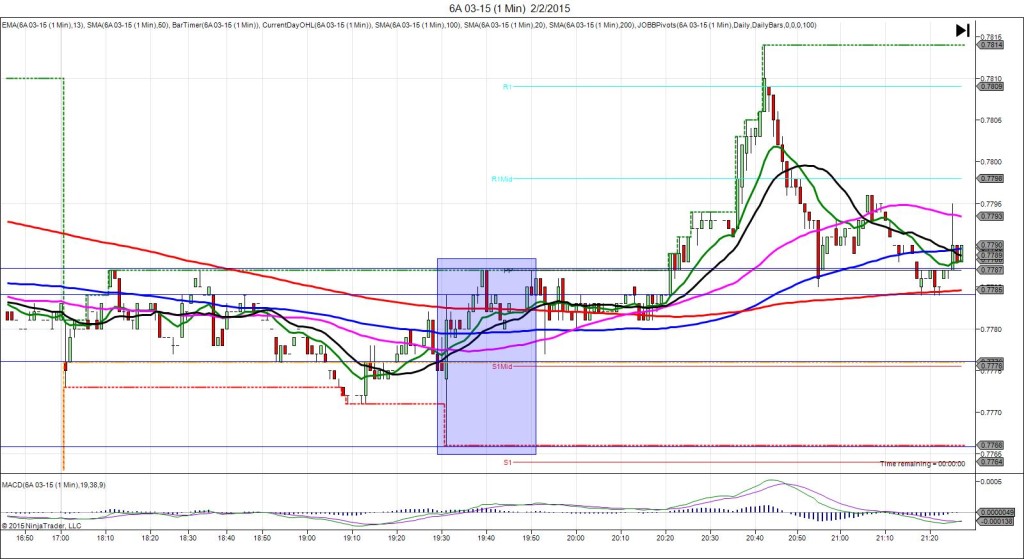

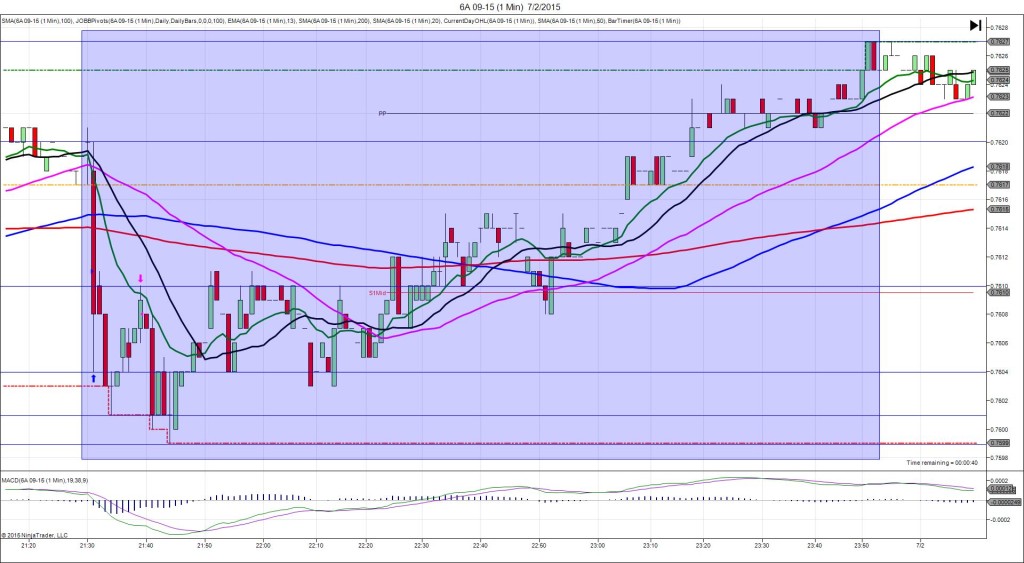

6/2/2015 RBA Rate Statement / Cash Rate (0030 EDT)

Forecast: 2.00% (no change)

Actual: 2.00% (no change)

TRAP TRADE – DULL NO FILL

Anchor point @ 0.7624

————

Trap Trade:

)))1st Peak @ 0.7658 – 0030:30 (1 min)

)))34 ticks

)))Reversal to 0.7641 – 0030:43 (1 min)

)))17 ticks

)))Pullback to 0.7657 – 0031:03 (2 min)

)))33 ticks

————

Reversal to 0.7635 – 0038 (8 min)

22 ticks

2nd Peak @ 0.7679 – 0049 (19 min)

55 ticks

Reversal to 0.7666 – 0051 (21 min)

13 ticks

Final Peak @ 0.7688 – 0124 (54 min)

64 ticks

Trap Trade Bracket setup:

Long entry – 0.7677 (just below the R2 Pivot)

Short entry – 0.7574 (just below the S1 Pivot)

Notes: After the last 4 reports had much volatility and larger moves, we continued the setting of a single tier at 50 ticks. The RBA made no major change in this cycle after previous action. This caused a 34 tick long spike in 30 sec that started on the 200 SMA and rose to cross the 100/50 SMAs near the origin, then reach the R2 Mid Pivot before reversing. This would have fallen short of the tier, so either move the order down to the area around 0.7655 after the market starts to reverse or cancel the order. It swung up and down between the R1 Pivot and R2 Mid Pivot a few times before eventually reversing to a little below the R1 Pivot after 8 min. Then it stepped higher for a 2nd peak on the R2 Pivot and a Final peak 9 ticks above that after an hour.