4/18/2016 RBA Monetary Policy Meeting Minutes (2130 EDT)

Forecast: n/a

Actual: n/a

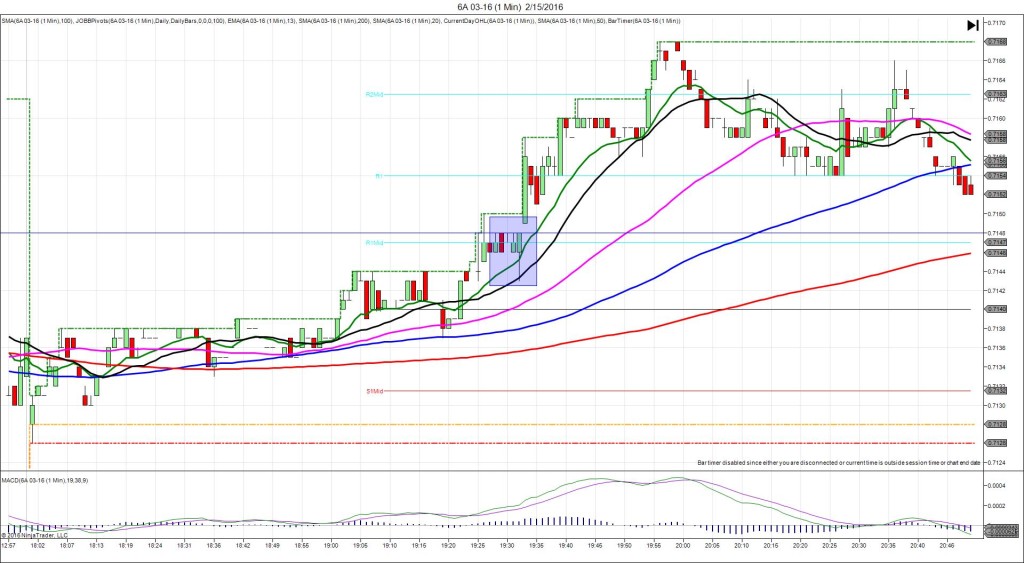

TRAP TRADE – INNER TIER

Anchor Pt @ 0.7756

—————-

Trap Trade:

)))1st peak @ 0.7746 – 2130:07 (1 min)

)))-10 ticks

)))Reversal to 0.7756 – 2130:16 (1 min)

)))10 ticks

)))Pullback to 0.7745 – 2131:47 (2 min)

)))11 ticks

—————-

Reversal to 0.7765 – 2138 (8 min)

20 ticks

Pullback to 0.7749 – 2147 (17 min)

16 ticks

Trap Trade Bracket setup:

Long entries – 0.7748 (on the R1 Pivot) / 0.7741 – No SMA / Pivot near)

Short entries – 0.7764 (just below the HOD) / 0.7771 (just above the R2 Pivot)

Expected Fill: 0.7748 – inner long tier

Best Initial Exit: 7762 – 14 ticks

Recommended Profit Target placement: 07756 (origin) and 0.7760 (just above the R2 Mid Pivot)

Notes: Good setup. It fell to eclipse the R1 Pivot then reverse as it filled the inner long tier. It reversed 10 ticks early allowing about 7 ticks to be captured. Then it pulled back and reversed more later allowing more profit with patience. It climbed to stall at the HOD then pulled back 16 ticks.