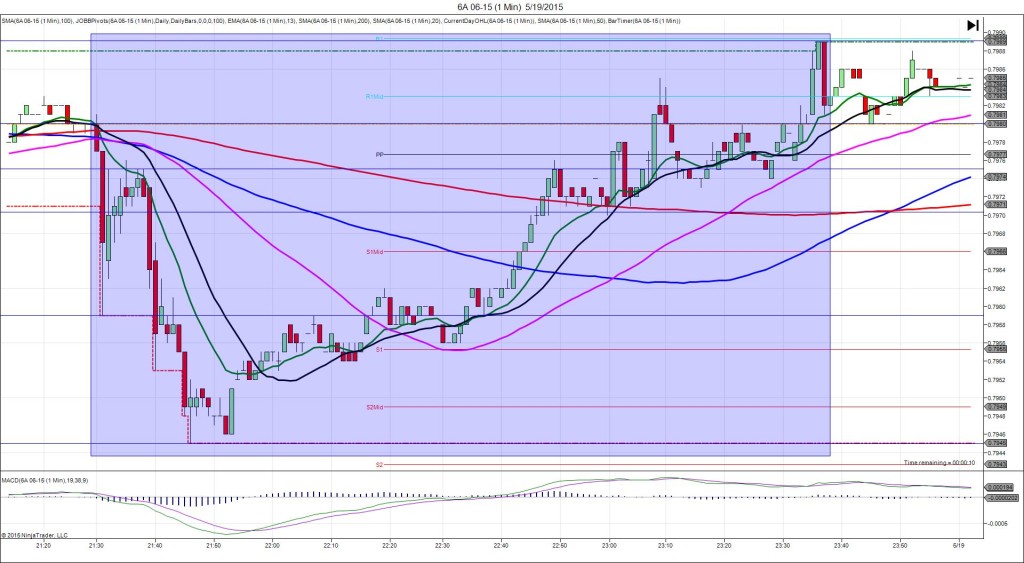

9/15/2014 RBA Monetary Policy Meeting Minutes (2130 EDT)

Forecast: n/a

Actual: n/a

TRAP TRADE – INNER TIER

Started @ 0.8982 (last price)

—————-

Trap Trade:

)))1st peak @ 0.8972 – 2130:06 (1 min)

)))-10 ticks

)))Reversal to 0.8988 – 2130:47 (1 min)

)))16 ticks

—————-

Pullback to 0.8983 – 2130:56 (1 min)

5 ticks

Reversal to 0.8996 – 2140 (10 min)

22 ticks

Pullback to 0.8983 – 2148 (18 min)

13 ticks

Trap Trade Bracket setup:

Long entries – 0.8974 (in between the PP Pivot and 200 SMA) / 0.8966 (just below the S1 Mid Pivot)

Short entries – 0.8990 (just above the R1 Pivot) / 0.8998 (on the R2 Mid Pivot)

Notes: Minutes caused a short reaction that fell 11 ticks initially after 6 sec to briefly penetrate the PP Pivot, then reverse quickly for about 10 ticks then another 6 ticks after another 30 sec. This would have been a perfect and easy setup for the trap trade. Your inner long entry would have filled with 2 ticks to spare, then you would have seen instant profit as it pulled up to the area of the R1 Mid Pivot. As it normally reversed to the opposite side of the origin, move your stop up to secure a few ticks, then set a target near the R1 Pivot at 0.8988. This would have filled allowing up to 14 ticks to be captured after 47 sec, then again on the :33 bar and later as it kept climbing for another 8 ticks. After that it pulled back to the 50 SMA in 8 min for 13 ticks. Then it traded sideways.