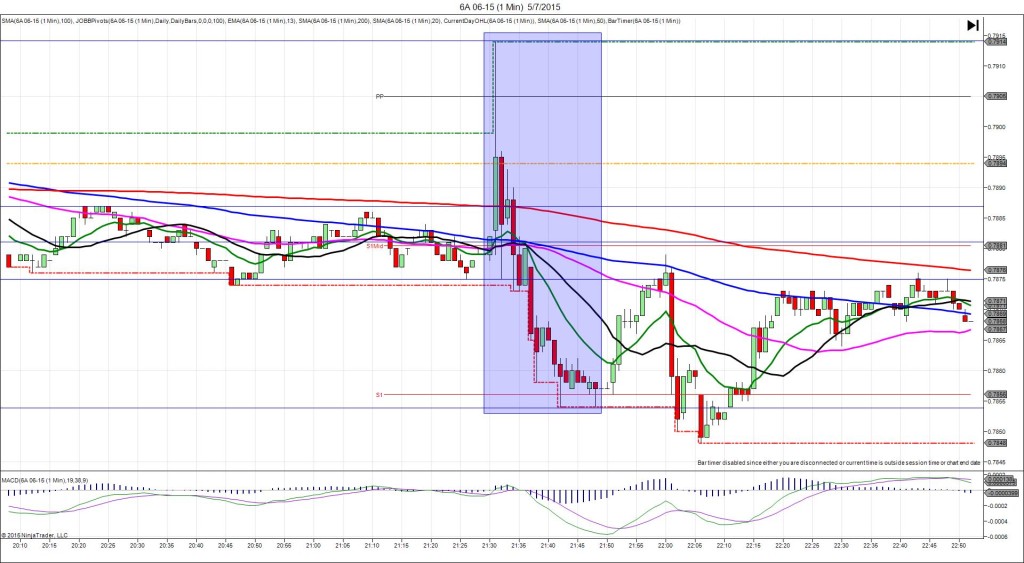

5/8/2014 Quarterly RBA Monetary Policy Statement (2130 EDT)

Forecast: n/a

Actual: n/a

INDECISIVE

Started @ 0.9338

Premature Spike @ 0.9333 – 2130 (0 min)

-5 ticks

1st Peak @ 0.9344 – 2131 (1 min)

11 ticks

Reversal to 0.9324 – 2131 (1 min)

-20 ticks

Notes: The Reserve Bank of Australia announced growth in Australia’s major trading partners appears to have moderated and Chinese slowing may be temporary. Unfortunately, Chinese CPI was releasing at the same time to cause instability. This caused a premature short move of 5 ticks followed by a reversal of 11 ticks, then a sustained short move of 20 ticks. With JOBB and a 3 tick bracket, your order would have filled short at 0.9335 with no slippage on the premature drop, then been stopped with a 6 tick loss on the immediate reversal with 1 tick of slippage. We should have sat this one out with the double booked report, but will chalk this up as a lesson learned. It continued to swing a few more times in the next 90 min.