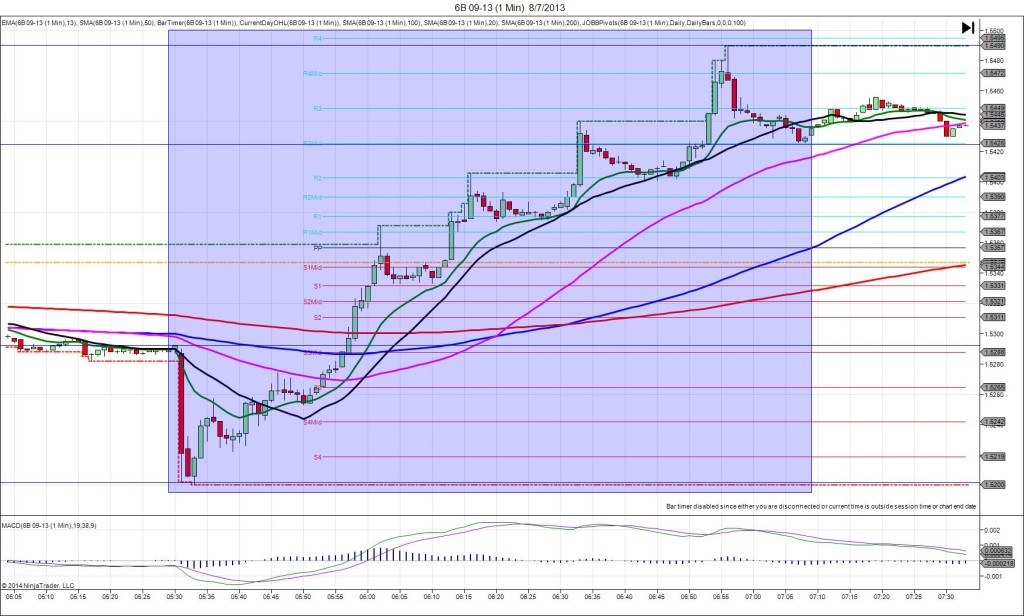

2/13/2013 BOE Inflation Report (0530 EST)

Forecast: n/a

Actual: n/a

SPIKE / REVERSE

Started @ 1.5646

1st Peak @ 1.5680 – 0531 (1 min)

34 ticks

Reversal to 1.5530 – 0605 (35 min)

150 ticks

Pullback to 1.5575 – 0656 (86 min)

45 ticks

Notes: The Bank of England left policy unchanged, having declined to take action to reduce inflation in the last 4 yrs. This caused a long spike of 34 ticks that crossed all 3 major SMAs and the R1 Mid Pivot, then peaked early in the :31 bar at the OOD. Since this report often reverses strongly, we advise exiting and/or reversing the trade after 6-8 sec of the initial move starting. It reversed for a total of 150 ticks in the next 35 min, crossing all3 major SMAs and eventually reaching the S2 Pivot. Trail the stop a few ticks above the 13 or 20 SMA and keep riding the move until the MACD crosses or the first bar settles above the 20. This would have secured over 120 ticks.