4/12/2016 Monthly Core CPI / CPI Report (0430 EDT)

CPI y/y Forecast: 0.3%

CPI y/y Actual: 0.5%

Previous Revision: n/a

PPI Input m/m Forecast: 2.4%

PPI Input m/m Actual: 2.0%

Previous Revision: n/a

RPI y/y Forecast: 1.4%

RPI y/y Actual: 1.6%

Previous Revision: n/a

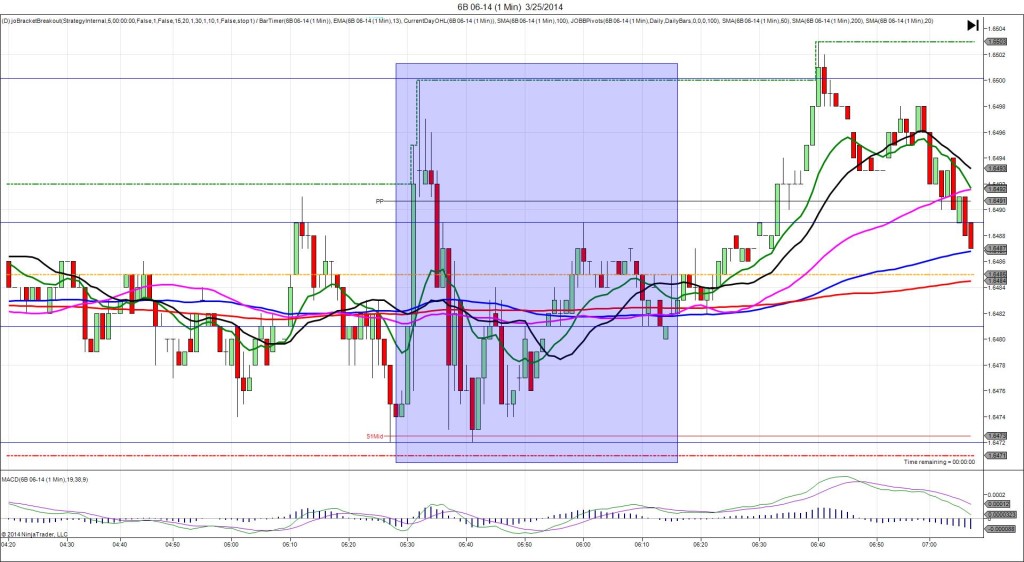

SPIKE / REVERSE (TRIGGER TO CANCEL)

Started @ 1.4281

1st Peak @ 1.4323 – 0430:00 (1 min)

42 ticks

Reversal to 1.4288 – 0430:02 (1 min)

35 ticks

Pullback to 1.4315 – 0434 (4 min)

27 ticks

Reversal to 1.4286 – 0438 (8 min)

29 ticks

Expected Fill: n/a – cancel

Slippage: n/a

Best Initial Exit: n/a

Recommended Profit Target placement: n/a

Notes: Trigger to cancel as a 20 tick short spike and reverse happened 10 sec before the report. Then we saw a 42 tick immediate spike that promptly collapsed. If traded the slippage would have probably exceeded 10 ticks and then put you in the red if not stopped. After that it trickled higher in 3 min before reversing to the 20 SMA. Then it continued to cycle.