3/24/2015 Monthly Core CPI / CPI Report (0530 EDT)

CPI y/y Forecast: 0.1%

CPI y/y Actual: 0.0%

Previous Revision: n/a

PPI Input m/m Forecast: 1.6%

PPI Input m/m Actual: 0.2%

Previous Revision: +0.1% to -3.6%

RPI y/y Forecast: 0.9%

RPI y/y Actual: 1.0%

Previous Revision: n/a

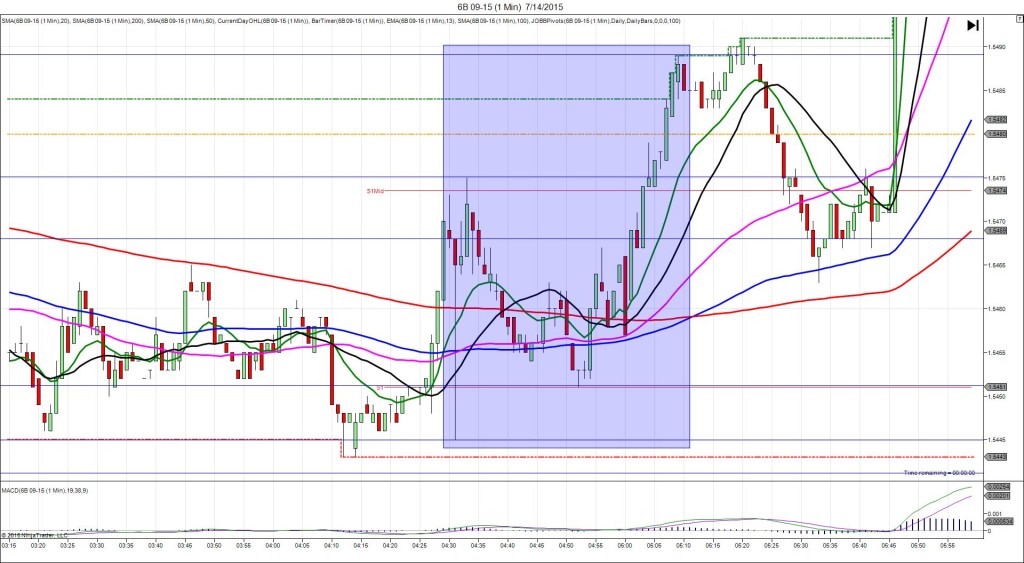

SPIKE WITH 2ND PEAK

Started @ 1.4939

1st Peak @ 1.4909 – 0530:02 (1 min)

30 ticks

Reversal to 1.4940 – 0531:06 (2 min)

31 ticks

2nd Peak @ 1.4887 – 0549 (19 min)

52 ticks

Reversal to 1.4939 – 0601 (31 min)

52 ticks

Notes: The CPI report came in 0.1% below the forecast, while the PPI input fell short of the forecast by 1.4% with a modest bullish revision, and the RPI exceeded the forecast by 0.1%. All of this caused a quick short spike of 30 ticks that was shortly sustained. It started just above the 20 SMA and fell to cross the 200 SMA and PP Pivot then touch the LOD. With JOBB, your short order would have filled at 1.4926 with 7 ticks of slippage. Then it fell and chopped between the PP Pivot and LOD for about 18 sec to allow an exit between 6 and 13 ticks. After the hovering, it reversed 31 ticks back to the origin at the beginning of the :32 bar. Then it fell for a 2nd peak of 22 ticks to the S1 Pivot in 17 min before reversing 52 ticks in 12 min to the 100 SMA.