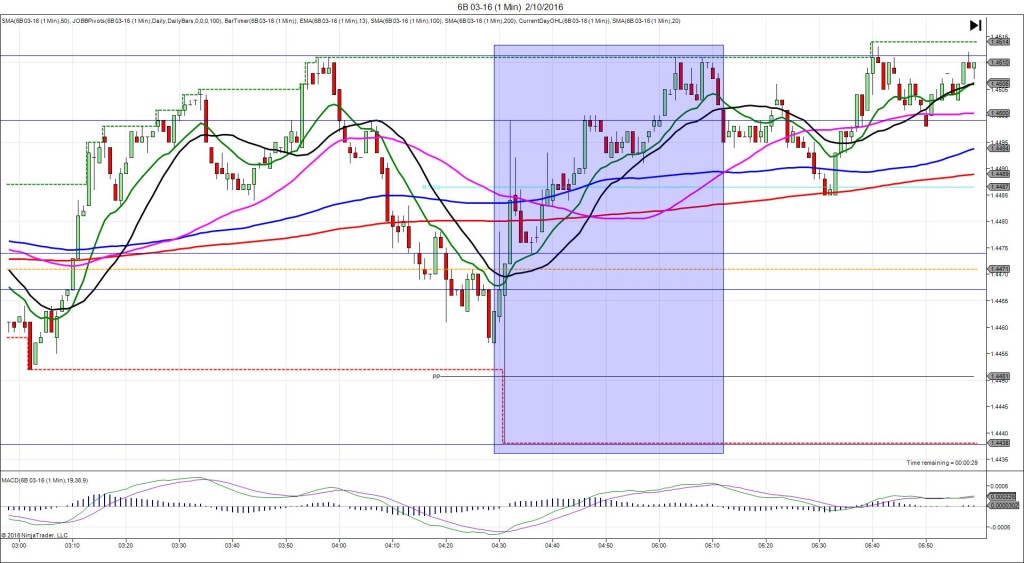

4/8/2016 Monthly Manufacturing PMI (0430 EST)

Forecast: -0.2%

Actual: -1.1%

Previous revision: -0.1% to -0.3%

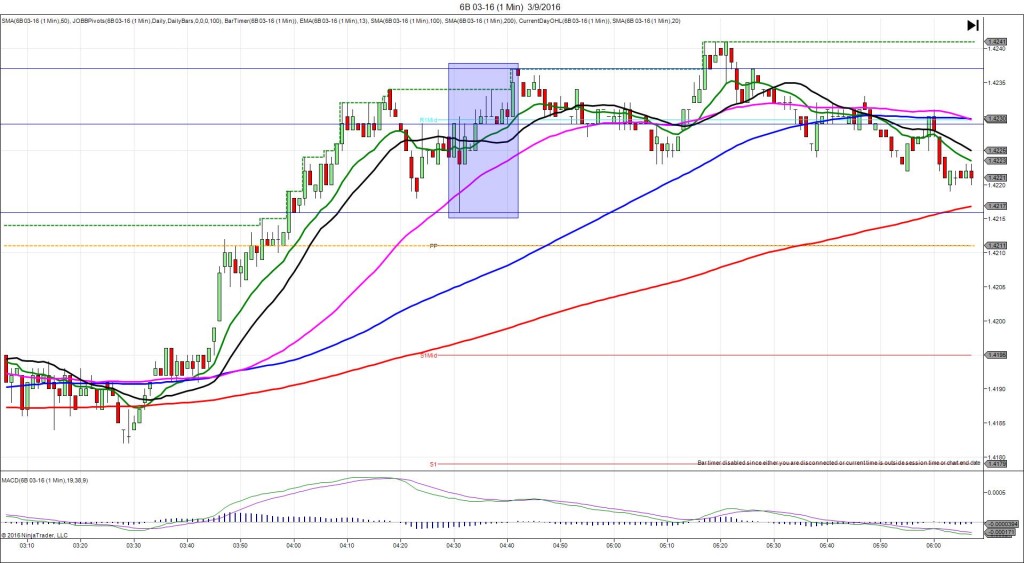

SPIKE WITH 2ND PEAK

Started @ 1.4126

1st Peak @ 1.4109 – 0431:11 (2 min)

17 ticks

Reversal to 1.4120 – 0434 (4 min)

11 ticks

2nd Peak @ 1.4095 – 0442 (12 min)

31 ticks

Expected Fill: 1.4121 (short)

Slippage: 1 tick

Best Initial Exit: 1.4110 – 11 ticks

Recommended Profit Target placement: 1.4103 (just below the R1 Pivot) – move higher

Notes: Nice short spike fell 17 ticks in a little over a minute to give a low slippage fill and allow up to 11 ticks to be captured. Then a small reversal followed by a 2nd peak of 14 more ticks to nearly reach the R1 Mid Pivot.