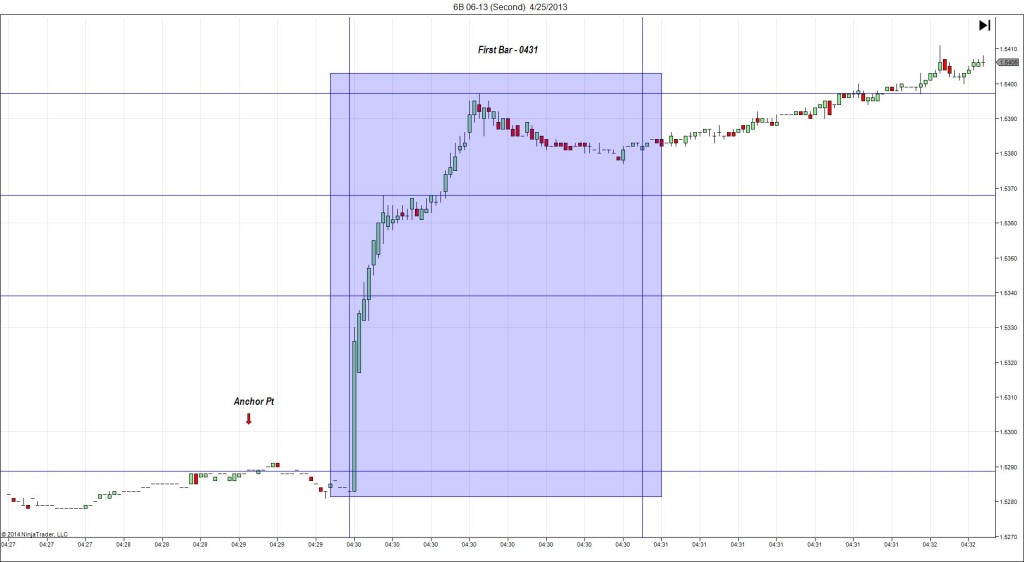

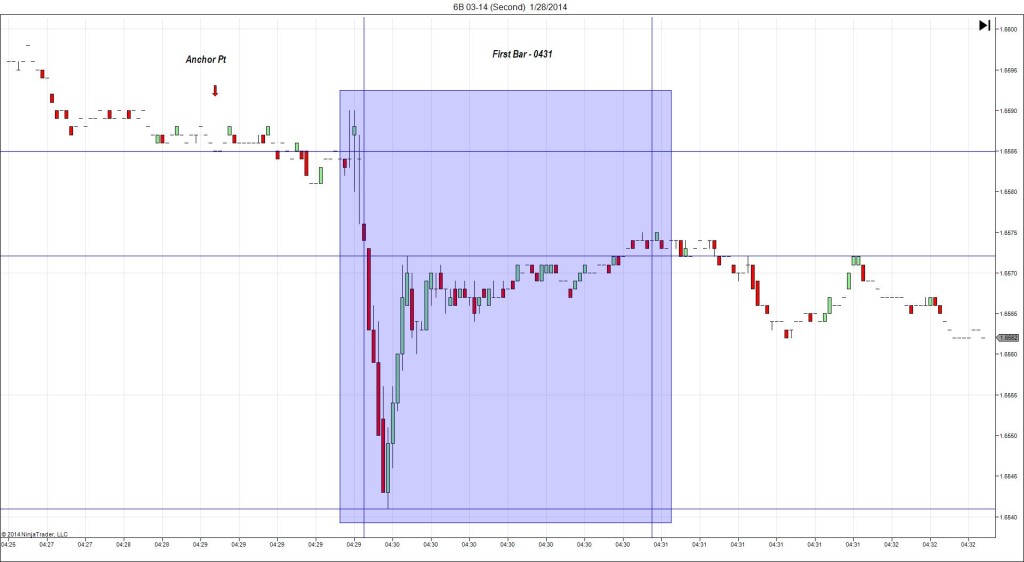

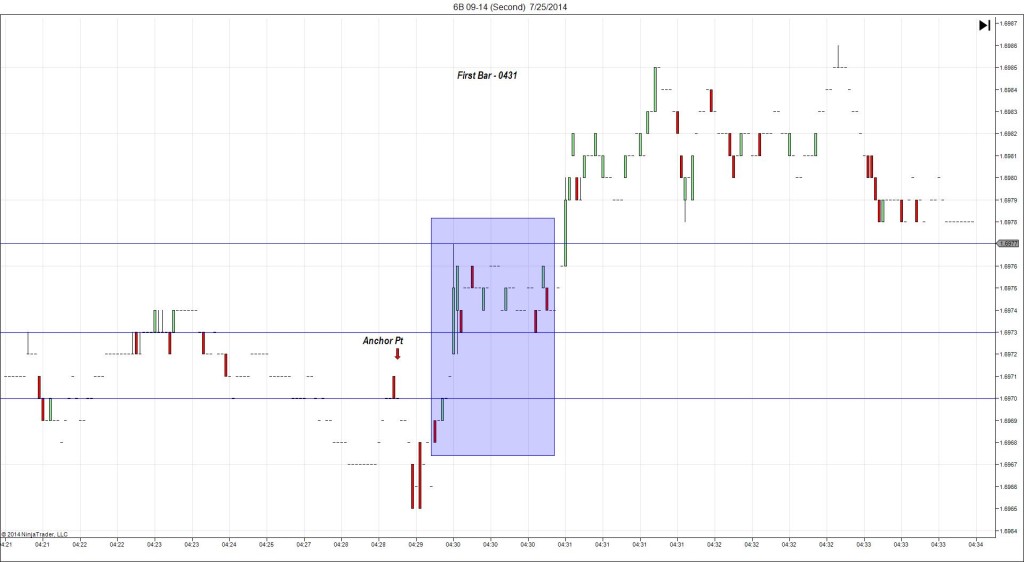

4/25/2013 Prelim GDP (0430 EDT)

Forecast: 0.1%

Actual: 0.3%

TRAP TRADE (STOP OUT)

Started @ 1.5289 (last price)

————

Trap Trade:

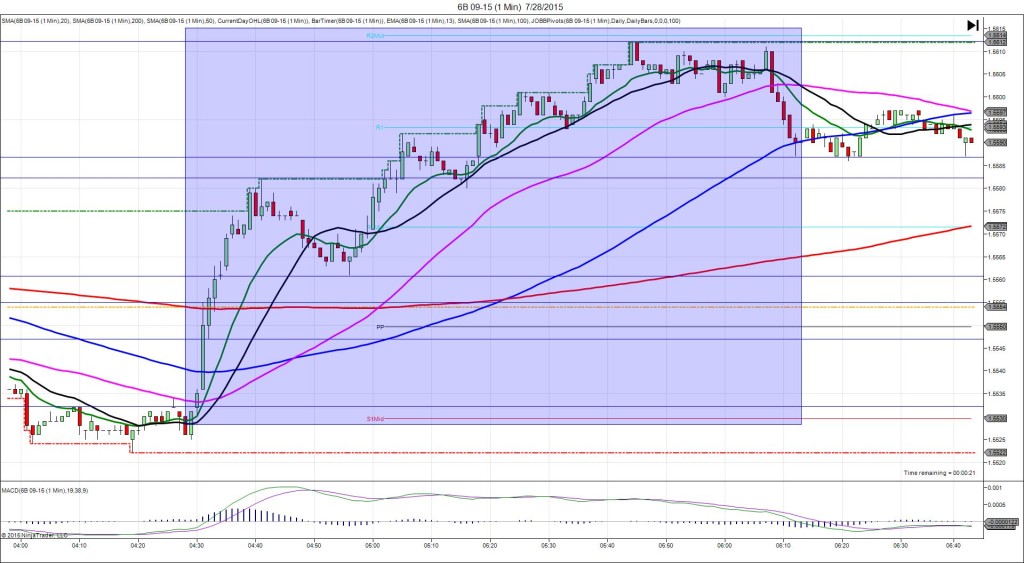

)))1st Peak @ 1.5368 – 0430:06 (1 min)

)))79 ticks

)))Reversal to 1.5358 – 0430:08 (1 min)

)))-10 ticks

)))2nd Peak @ 1.5397 – 0430:26 (1 min)

)))39 ticks

————

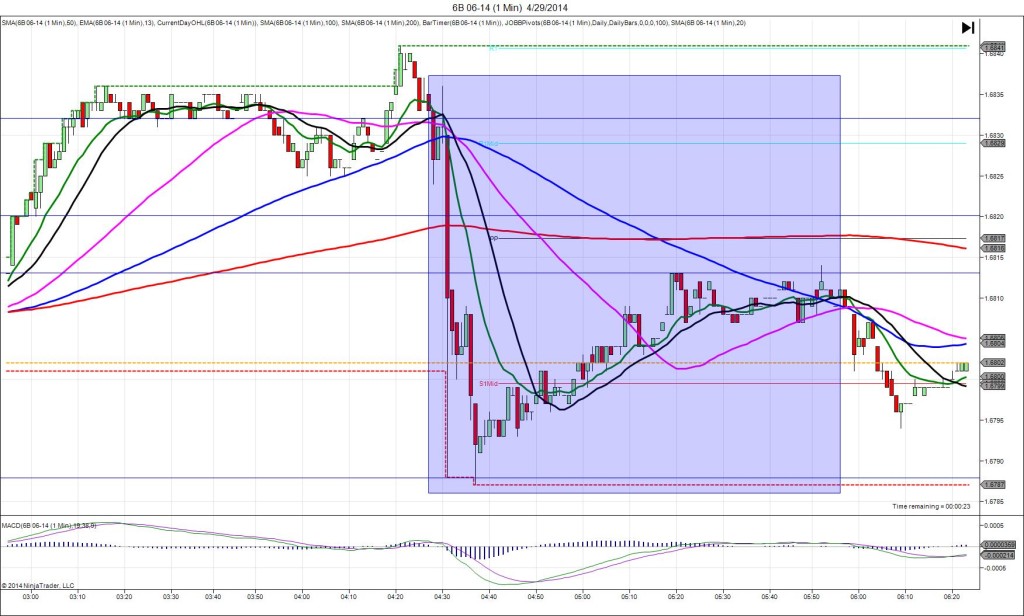

Peak @ 1.5411 – 0433 (3 min)

122 ticks

Reversal to 1.5390 – 0436 (6 min)

21 ticks

Final Peak @ 1.5443 – 0506 (36 min)

154 ticks

Reversal to 1.5420 – 0524 (54 min)

23 ticks

Trap Trade Bracket setup:

Long entries – 1.5252 (on the S1 Mid Pivot) / 1.5238 (just below the S1 Pivot)

Short entries – 1.5324 (no SMA/Pivot near) / 1.5339 (just above the R3 Pivot)

Notes: The reading came in 0.2% above the forecast to impress the market. This caused a long spike of 79 ticks after 6 sec that started on the R2 Mid Pivot and eclipsed all 3 major SMAs, the R4 Pivot and HOD. This would have filled both short entries and then the stops for a loss of about 32 ticks total. The large reaction and bias long without any reversal along the way is an anomaly. It continued to climb to 1.5411 on the :33 bar, chopped sideways for about 25 min, then used the 13/20 SMAs as a springboard to climb for a final peak at 1.5443 for 154 total ticks.