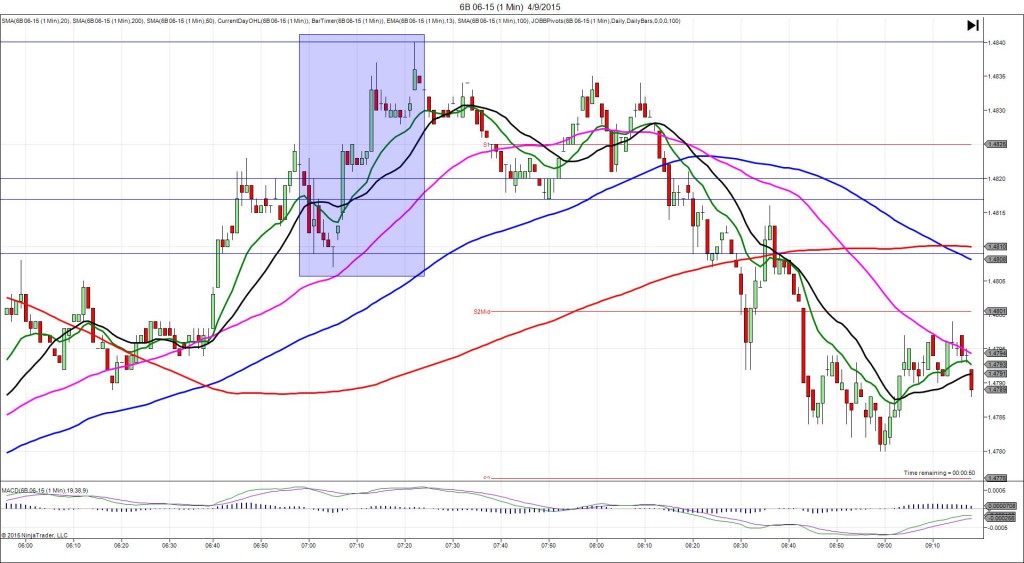

4/9/2015 Official Bank Rate / Asset Purchase Facility (0700 EST)

Forecast: 0.50%

Actual: 0.50%

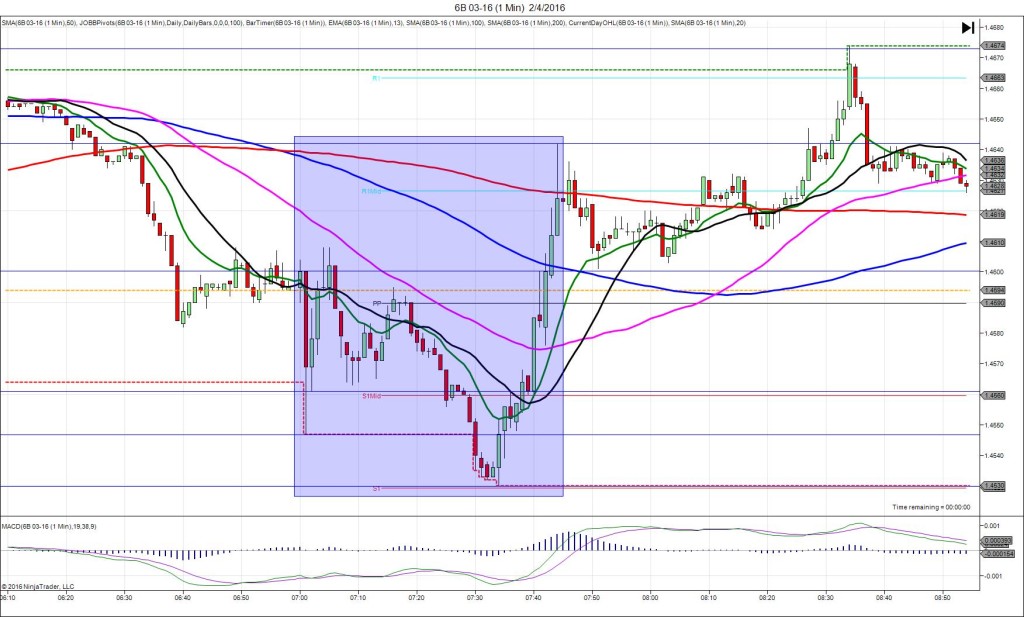

TRAP TRADE – DULL NO FILL

Anchor Pt @ 1.4821 – shift 4 ticks down to 1.4817

————

Trap Trade:

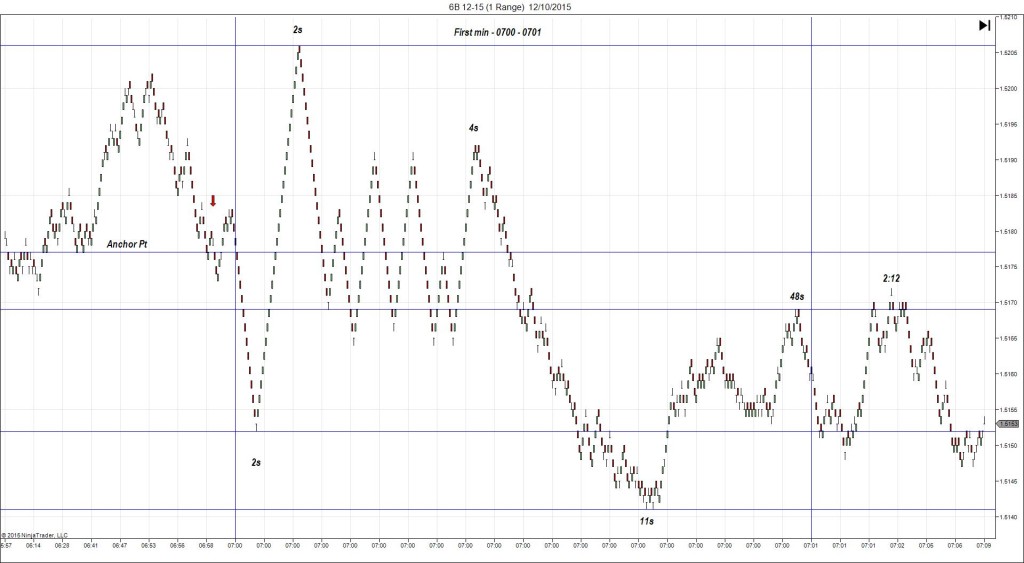

)))1st Peak @ 1.4809 – 0700:02 (1 min)

)))-8 ticks

)))Reversal to 1.4820 – 0700:08 (1 min)

)))11 ticks

————

Pullback to 1.4807 – 0705 (5 min)

13 ticks

Reversal to 1.4840 – 0722 (22 min)

33 ticks

Trap Trade Bracket setup:

Long entries – 1.4808 (just above the 50 SMA) / 1.4799 (just below the S2 Mid Pivot)

Short entries – 1.4826 (just above the S1 Pivot) / 1.4836 (No SMA / Pivot near)

Notes: The Bank of England left rates unchanged as expected, and the Asset Purchase Facility also remained unchanged. The initial anchor point would have shifted lower about 4 ticks after the 45 sec buffer, so bias the orders lower as time lapses. This caused a short spike of 8 ticks that was just a little short of the inner long entry and was too brief so cancel the order. After that it reversed 11 ticks in 6 sec then slowly trickled down for a pullback of 13 ticks in 4 min. Then it reversed 33 ticks in 17 min.