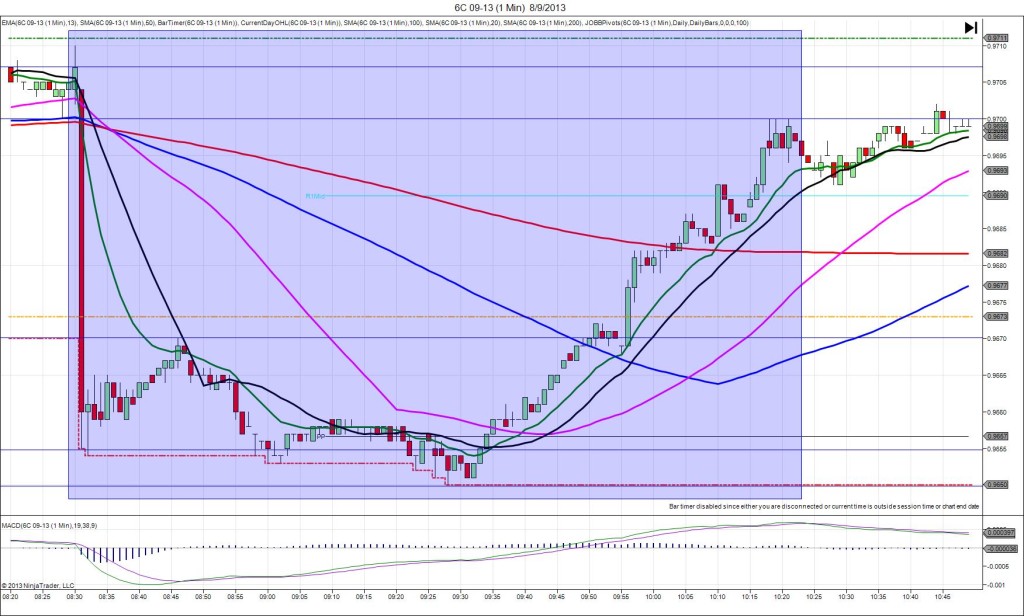

8/9/2013 Employment Change (0830 EDT)

Employment Change Forecast: 6.2K

Employment Change Actual: -39.4K

Previous Revision: n/a

Rate Forecast: 7.1%

Rate Actual: 7.2%

SPIKE WITH 2ND PEAK

Started @ 0.9707

1st Peak @ 0.9655 – 0831 (1 min)

52 ticks

Reversal to 0.9670 – 0846 (16 min)

15 ticks

2nd Peak @ 0.9650 – 0928 (58 min)

57 ticks

Reversal to 0.9700 – 1018 (108 min)

50 ticks

Notes: Strongly negative report showing a loss of nearly 40K jobs and an uptick in the unemployment rate. This caused the 6C to spike short for 52 ticks on the :31 bar. With JOBB, you would have filled short at 0.9697 with 3 ticks of slippage, then seen it fall like a rock. Look to exit near 0.9660 or the PP Pivot at 0.9657 for up to 40 ticks. After the 1st peak, it reversed 15 ticks back to the 13/20 SMAs in 15 min, then fell for a modest 2nd peak of 5 more ticks at the bottom of the hour. Then the reversal took over to reclaim 50 ticks in the next 50 min ,as it fought through every SMA and the R1 Mid Pivot to nearly come back up to the origin.

-090712.jpg)

-081012.jpg)

-070612.jpg)

-060812.jpg)

-051112.jpg)

-040512.jpg)

-030912.jpg)