8/20/2015 CNY Caixin Flash Manufacturing PMI (2145 EDT)

Forecast: 48.1

Actual: 47.1

Previous Revision: -0.4 to 48.2

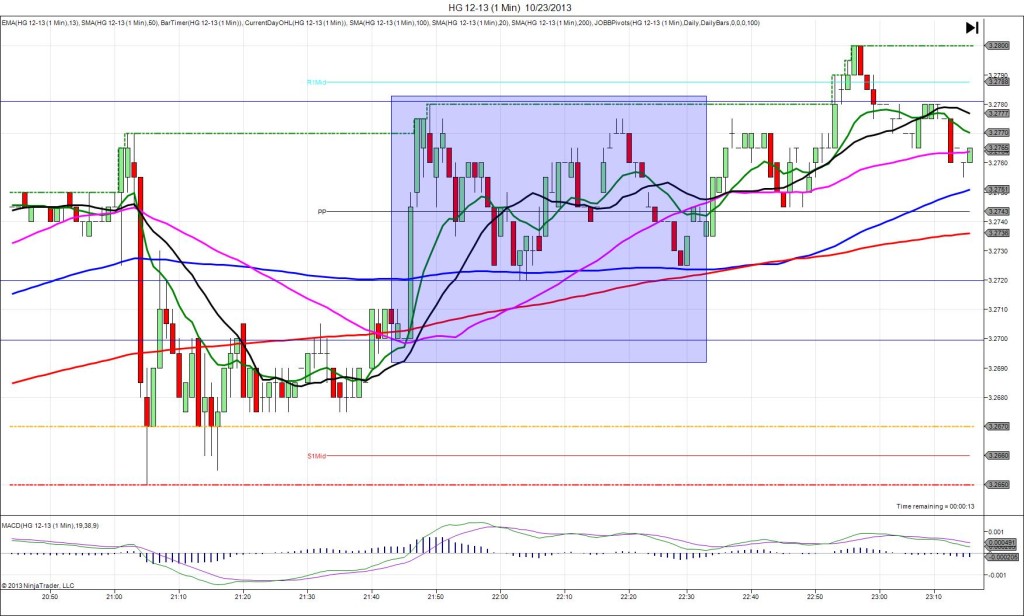

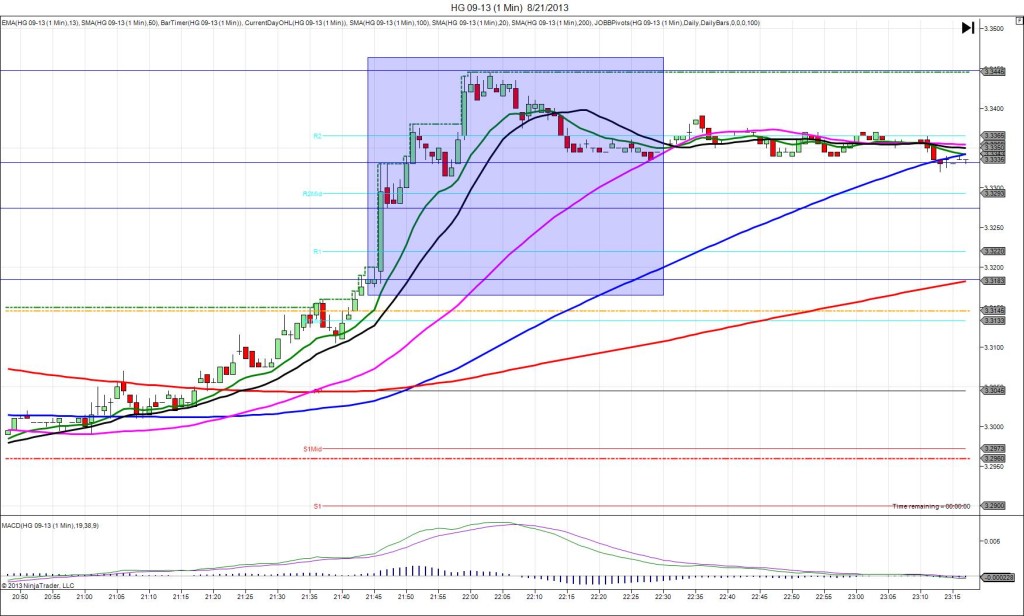

SPIKE / REVERSE

Started @ 2.3125

1st Peak @ 2.3095 – 2145:59 (1 min)

6 ticks

Reversal to 2.3145 – 2151 (6 min)

10 ticks

Pullback to 2.3100 – 2157 (12 min)

9 ticks

Reversal to 2.3145 – 2210 (25 min)

9 ticks

Notes: Report fell short of the forecast by 1.0 pts with a modest downward previous report revision. This caused a slow developing short spike of only 6 ticks that took about a min to realize. With JOBB and a 3 tick bracket, your short order would have filled at 2.3110 with no slippage. Then you would been able to capture 1-2 ticks when it hovered near the bottom. Move the stop to breakeven if you are waiting for a larger drop as it often peaks later. After that it reversed 10 ticks in 5 min back to the 20 SMA before pulling back 9 ticks in 6 min. Then it reversed 9 ticks to the 50 SMA in 13 min.

We also recommended the 6A as an alternative to the HG with limit orders using 10 as the slippage setting. It saw a short spike of 17 ticks allowing up to 8 ticks to be captured.