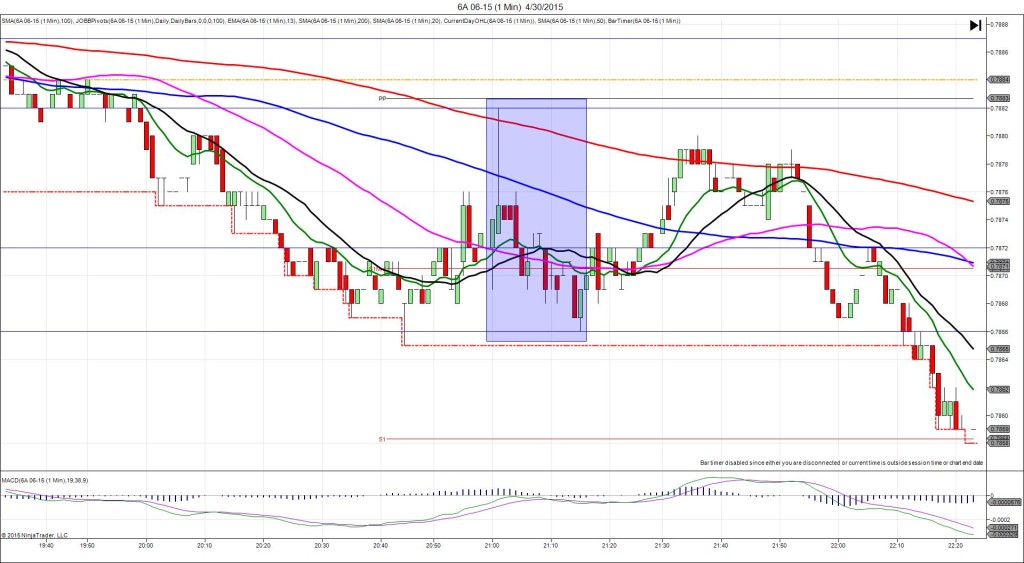

3/31/2015 CNY Manufacturing PMI (2100 EDT)

Forecast: 49.7

Actual: 50.1

Previous Revision: n/a

SPIKE WITH 2ND PEAK

Started @ 0.7600 (2059)

1st Peak @ 0.7618 – 2100:58 (2 min)

18 ticks

Reversal to 0.7611 – 2103 (4 min)

7 ticks

2nd Peak @ 0.7635 – 2011 (12 min)

35 ticks

Reversal to 0.7615 – 2120 (21 min)

20 ticks

Continued Reversal to 0.7607 – 2143 (44 min)

28 ticks

Notes: Report exceeded the forecast by 0.4% to cause a 18 tick long spike that started on the 13 SMA and rose to cross the R1 Pivot and nearly reach the R2 Mid Pivot. As usual it released about 15 sec early. With JOBB you would have been filled long at 0.7605 with no slippage then been able to exit with 12 ticks as it hovered at the high point for several seconds late in the :01 bar. After that it reversed for 7 ticks in the next 2 min before climbing for a 2nd peak of 17 more ticks as it crossed the R2 Pivot in the next 8 min. Then it reversed 20 ticks in 9 min to the 13/20 SMAs and another 8 ticks in the next 23 min to the R1 Pivot.

We advised a delayed approach on the HG 05-15. It would have been safe on the initial reaction, but jumping in long at the beginning of the :02 bar would have been safe for 24 ticks in 5 min.