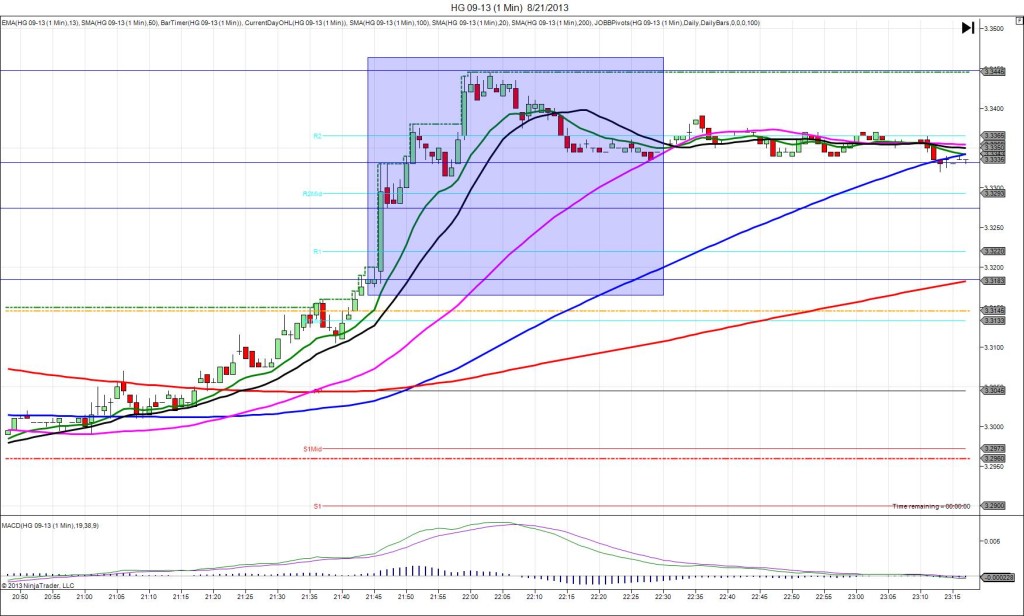

8/21/2013 CNY HSBC Flash Manufacturing PMI (2145 EDT)

Forecast: 48.3

Actual: 50.1

Previous Revision: n/a

SPIKE WITH 2ND PEAK

Started @ 3.3185

1st Peak @ 3.3330 – 2146 (1 min)

29 ticks

Reversal to 3.3275 – 2147 (2 min)

11 ticks

Final Peak @ 3.3445 – 2200 (15 min)

52 ticks

Reversal to 3.3335 – 2228 (43 min)

22 ticks

Notes: Report impressed the traders, with no previous report revision with a reading barely above 50. This caused a long spike of 29 ticks that eclipsed the R2 Mid Pivot and sustained most of the advance on the :46 bar. The market had been trending higher for about an hour before the report with the SMAs rising, so the short spike started above the 13 SMA. With JOBB, you would have filled long at 3.3225 with 3 ticks of slippage. Look to exit near the R2 Mid Pivot at about 3.3300 with about 15 ticks. If you are a bit more savvy, knowing the bullish results and the propensity for a 2nd peak, stay in and wait until it hits the R2 Pivot for another 14 ticks, or when the 13 SMA crosses the 20 SMA / MACD crosses for another 25 ticks. After the 1st peak, it stepped higher twice to hit a final peak of 52 ticks on the :00 bar about halfway between the R2 Pivot and R3 Mid Pivot. Then it reversed for a protracted 22 ticks in about 30 min back to the 50 SMA. After that it traded sideways.