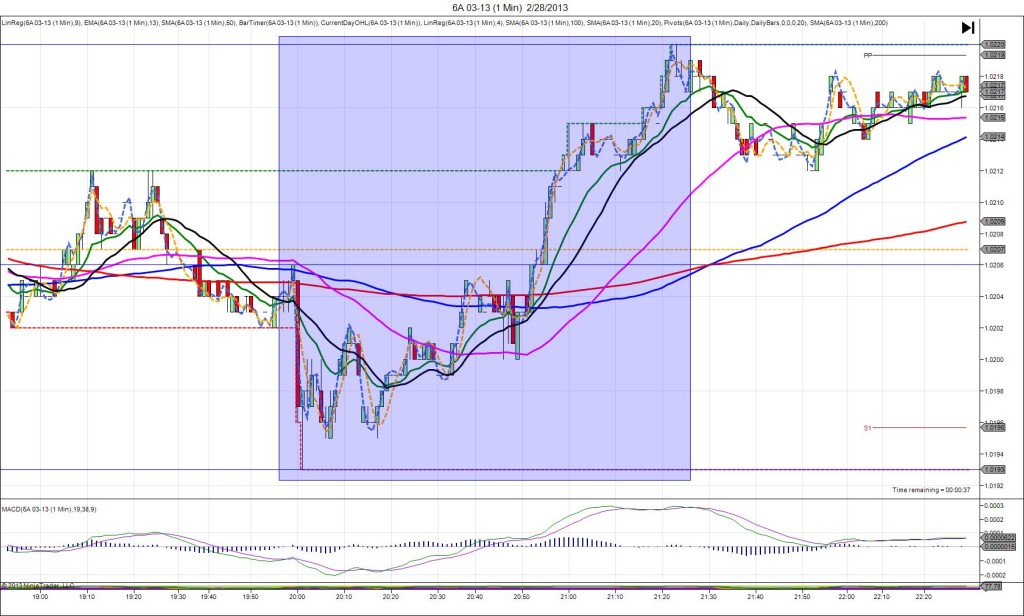

2/24/2013 CNY HSBC Flash Manufacturing PMI (2045 EST)

Forecast: 52.2

Actual: 50.4

Previous Revision: +0.4 to 52.3

SPIKE/REVERSE

Started @ 1.0279

1st Peak @ 1.0246 – 2051 (6 min)

33 ticks

Reversal to 1.0258 – 2122 (37 min)

12 ticks

Extended Reversal to 1.0270 – 0012 (207 min)

24 ticks

Notes: Report disappointed the traders, with a moderate positive previous report upward revision. This caused a short spike of 33 ticks (30 on the :46 bar) that peaked on the :51 bar. The market had been trending slightly lower before the report, but had begun to correct, so the short spike was able to use the 100 and 50 SMAs near the origin more as resistance to accelerate the short move. Then it crossed the S2 Pivot and bottomed at 1.0246. With JOBB, you would have filled short at 1.0465 with abnormally high 10 ticks of slippage. Look to exit around 1.0250 where it hovered as the :46 bar was expiring. It then reversed for 12 ticks in the next 30 min back to the 50 SMA. After trending sideways and struggling to reverse through the SMAs, it eventually achieved 24 ticks about 3.5 hrs after the report.

-011713.jpg)

-011612.jpg)

-112112.jpg)

-103112.jpg)