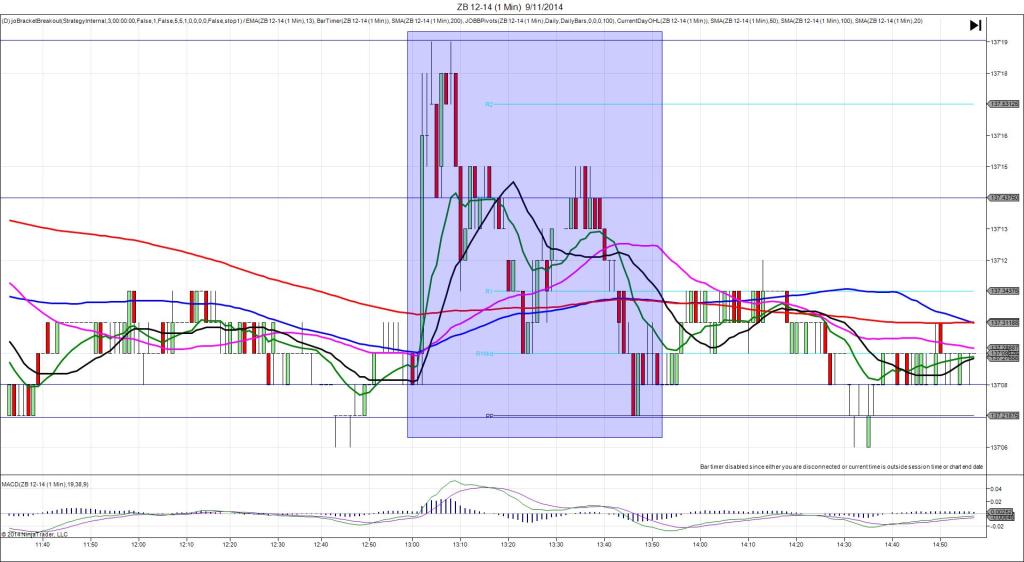

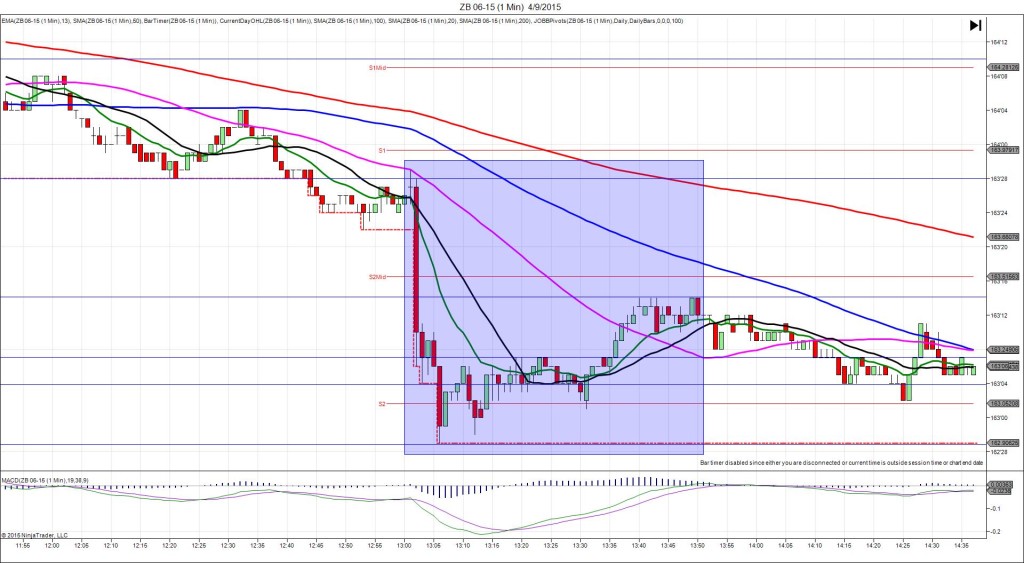

9/11/2014 30-yr Bond Auction (1301 EDT)

Previous: 3.22/2.6

Actual: 3.24/2.7

SPIKE / REVERSE

Started @ 137’08 (1301)

1st Peak @ 137’19 – 1303:06 (2 min)

11 ticks

Reversal to 137’14 – 1305 (4 min)

5 ticks

Double top to 137’19 – 1308 (7 min)

5 ticks

Reversal to 137’09 – 1323 (22 min)

10 ticks

Pullback to 137’15 – 1334 (33 min)

6 ticks

Reversal to 137’07 – 1346 (45 min)

8 ticks

Notes: Report is scheduled on Forex Factory at the bottom of the hour, but the spike always breaks 1 min late. The highest yield rose slightly from last month, but the demand rose. This caused the bonds to spike long for a healthy reaction of 11 ticks that started on the 100 / 50 SMAs and R1 Mid Pivot then rose to cross the 200 SMA and R2 Pivot. With JOBB you would have filled long at 137’13 with 2 ticks of slippage, then seen it hover around 137’17 near the R2 Pivot for over a minute for an ideal exit of 4-5 ticks. It peaked at 137’19 early in the :04 bar, then chopped in the next 5 min. Then it reversed 10 ticks in the next 15 min to the R1 Mid Pivot. After that it pulled back for 6 ticks in 11 min before reversing for 8 ticks in the next 22 min.