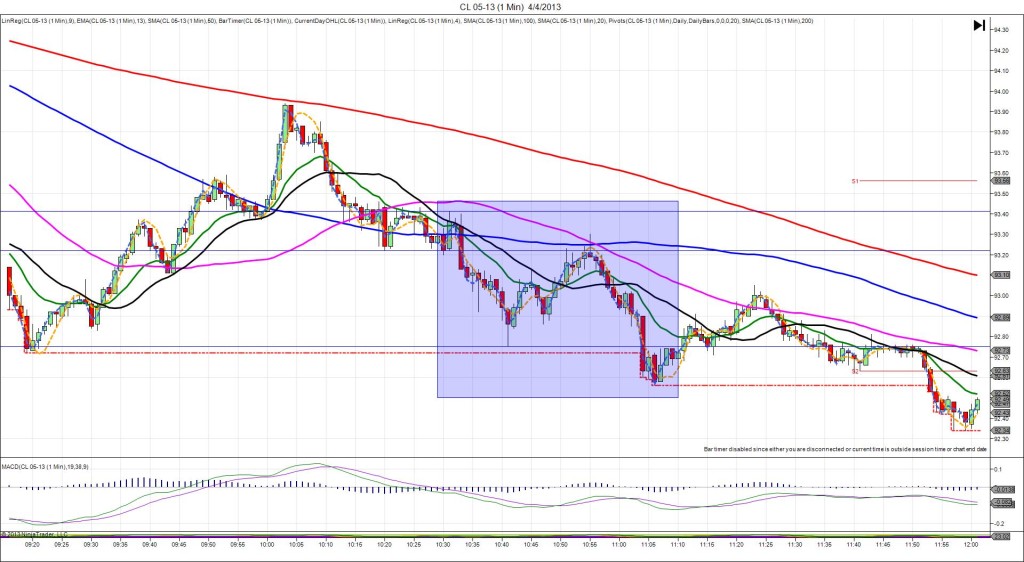

4/4/2013 FED Chairman Bernanke Speech (1030 EDT)

Forecast: n/a

Actual: n/a

SPIKE/REVERSE

Started @ 93.22

1st Peak @ 93.41 – 1031 (1 min)

19 ticks

Reversal to 92.75 – 1041 (11 min)

66 ticks

Notes: FED Chair Bernanke spoke about the financial and economic education at the Redefining Investment Strategy Education Conference in Dayton, via satellite. He did not discuss QE3, so there was not much to excite the market on this event. With JOBB, you would have filled long at about 93.29 with 2 ticks of slippage. The market was already engaged in a short move, so it went against the grain and crossed the 100 SMA and found resistance at the 20 SMA. Since the market was in a downtrend and it was unable to close above the 20 SMA, move the stop up to the 100 SMA, then look to exit around 93.39. You would have taken 10 ticks or been stopped with 1 tick profit. The reversal continued with the downtrend nearly down to the LOD for 66 ticks. Then the market corrected back to the intersection of the 50 and 100 SMAs, before falling again.

-011613.jpg)

-112812.jpg)

-111512.jpg)

-102412.jpg)

-101012.jpg)

-100112.jpg)

-091312.jpg)

-083112.jpg)