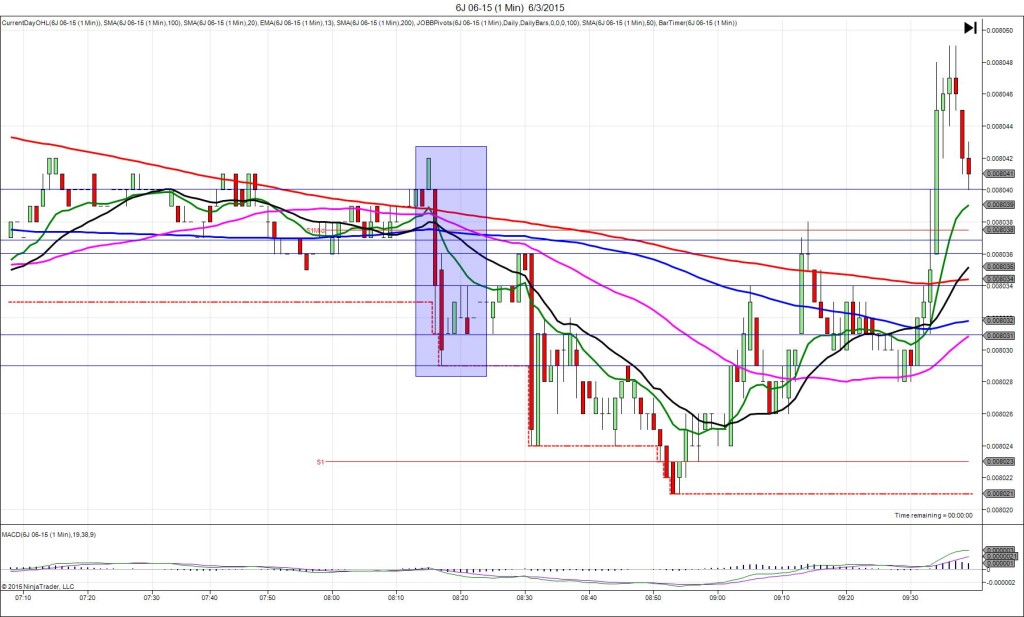

10/1/2014 ADP Non-Farm Employment Change (0815 EDT)

Forecast: 207K

Actual: 213K

Previous revision: -2K to 202K

TRAP TRADE – DULL NO FILL

Anchor Point @ 0.009102 (last price)

————

Trap Trade:

)))1st Peak @ 0.009096 – 0815:02 (1 min)

)))-6 ticks

)))Reversal to 0.009104 – 0815:59 (1 min)

)))8 ticks

————

Continued Reversal to 0.009122 – 0824 (9 min)

26 ticks

Extended Reversal to 0.009131 – 0902 (47 min)

35 ticks

Trap Trade Bracket setup:

Long entries – 0.009093 (No SMA / Pivot near) / 0.009083 (just below the S3 Mid Pivot)

Short entries – 0.009110 (just above the 200 SMA / S1 Pivot / 0.009122 (just below the PP Pivot)

Notes: Report came in nearly matching the forecast to cause a tame whipsaw that fell 6 ticks then reversed 8 ticks through the course of the :31 bar. That would have missed the inner short entry by 3 ticks, making it an easy decision to cancel the order. Since it was a near match and only moved 6 ticks from the origin, a manual entry would not be prudent. After the initial reversal of 8 ticks, it climbed another 18 ticks in 8 min to the PP Pivot, then another 9 ticks in 38 min to the HOD / R1 Mid Pivot.