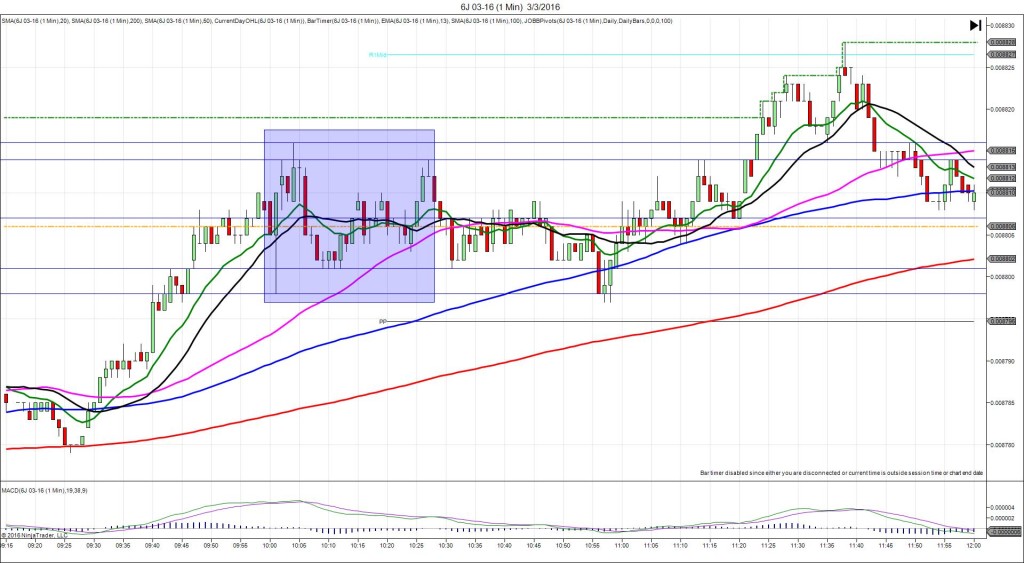

4/5/2016 Monthly ISM Non-Manufacturing PMI (1000 EDT)

Forecast: 54.1

Actual: 54.5

Previous Revision: n/a

INDECISIVE

Started @ 0.0090625

Head Fake @ 0.0090645 – 1000:07 (1 min)

4 ticks

1st Peak @ 0.0090490 – 1001:17 (2 min)

27 ticks

Reversal to 0.0090620 – 1015 (15 min)

26 ticks

Expected Fill: 0.0090640 (long)

Slippage: 0 ticks

Best Initial Exit: 0.0090620 – 4 tick loss

Recommended Profit Target placement: n/a

Notes: Strange reaction as we saw a slow mild head fake in the long (wrong) direction. Be wary with this situation as you are seeing a long fill with the results and hovering on the fill point. Either exit quickly or move the stop to a very tight spot. After 30 sec it started to trickle short and gained momentum to achieve 27 ticks in 47 sec. Then a reversal back to the SMAs in 13 min.