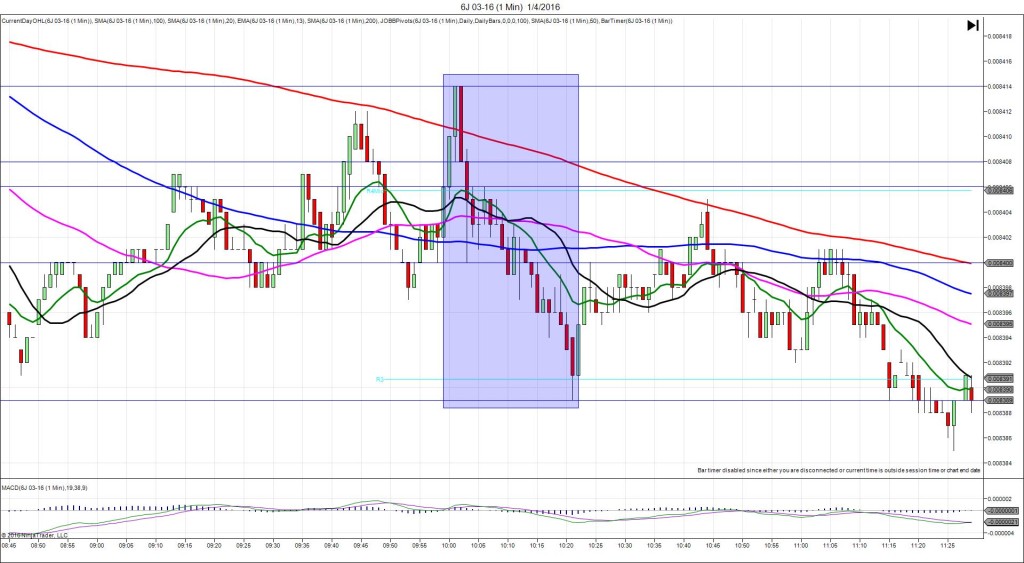

1/4/2016 Monthly ISM Manufacturing PMI (1000 EDT)

Forecast: 49.1

Actual: 48.2

Previous revision: n/a

SPIKE / REVERSE

Started @ 0.008408

1st Peak @ 0.008414 – 1000:37 (1 min)

6 ticks

Reversal to 0.008400 – 1003 (3 min)

14 ticks

Pullback to 0.008406 – 1004 (4 min)

6 ticks

Reversal to 0.008389 – 1021 (21 min)

17 ticks

Expected Fill: 0.008411 (long)

Slippage: 0 ticks

Best Initial Exit: 0.008414 – 3 ticks

Recommended Profit Target placement: 0.008420 (just below the R4 Pivot) – move down

Notes: Small spike due to minimal offset and resistance of the 200 SMA. Look for the first sign of hovering to exit or reverse the trade as this is a good reversal setup.