10/30/2013 ADP Non-Farm Employment Change (0815 EDT)

Forecast: 151K

Actual: 130K

Previous revision: -21K to 145K

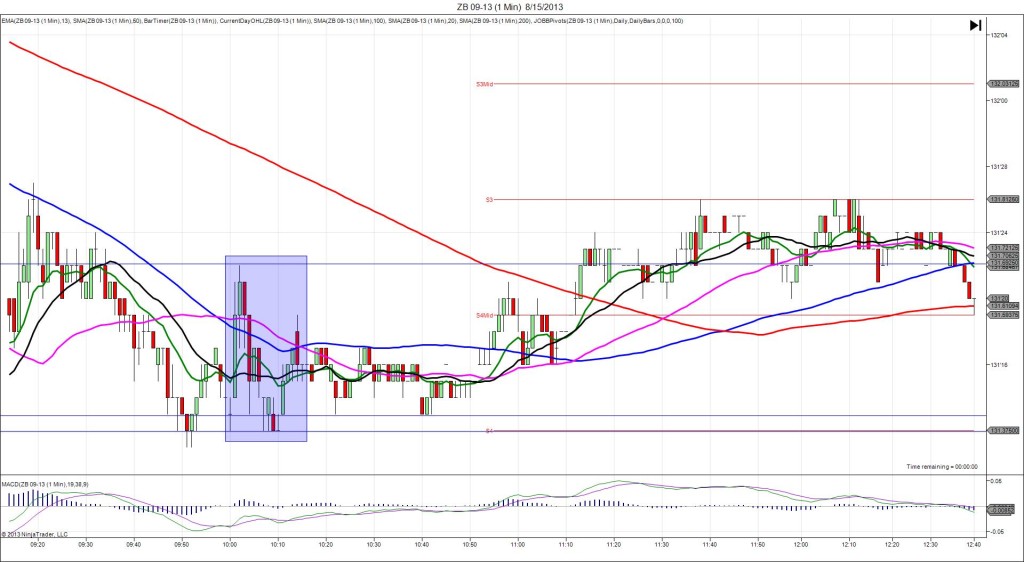

SPIKE / REVERSE

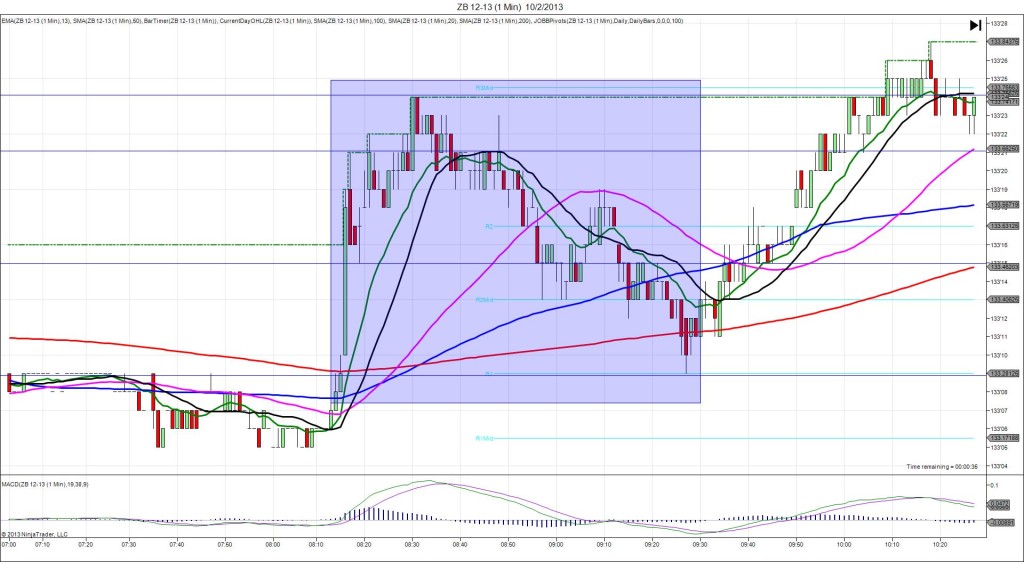

Started @ 135’13

1st Peak @ 135’18 – 0816 (1 min)

5 ticks

Reversal to 135’08 – 0903 (48 min)

10 ticks

Notes: Report fell short of the forecast by 21K jobs along with a sizeable 21K downward revision to the previous report. This caused a nearly dull reaction of 5 ticks, peaking on the :16 bar as it crossed the 100/200 SMAs and the R2 Mid Pivot. With JOBB, you would have filled long at about 135’16 with no slippage, then seen it remain between 1 tick in the red and 2 ticks of profit. The small move with the deviation of the results is odd, so I would move the stop up to 135’15, just below the 200 SMA and wait for the :17 bar to gain a few more ticks. When that did not happen, look to exit at 0 or 1 tick of profit. After the peak, it backed off and chopped lower for 10 ticks in about 45 min to the R1 Mid Pivot and LOD. After that it rebounded and traded sideways around the major SMAs.