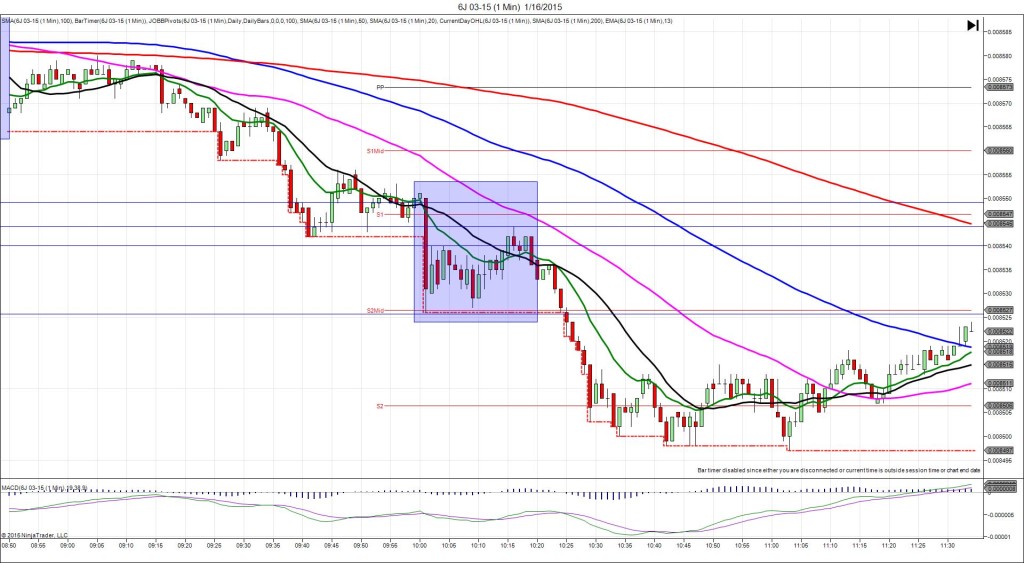

9/12/2014 Prelim UoM Consumer Sentiment (0955 EDT)

Forecast: 83.2

Actual: 84.6

TRAP TRADE (DULL – No Fill)

Anchor Point @ 0.0009322 (last price)

————

Trap Trade:

)))1st Peak @ 0.009319 – 0956:36 (2 min)

)))-3 ticks

)))Reversal to 0.009323 – 0957:51 (3 min)

)))4 ticks

————

Continued Reversal to 0.009335 – 1017 (22 min)

16 ticks

Pullback to 0.009318 – 1044 (49 min)

17 ticks

Trap Trade Bracket setup:

Long entries – 0.009316 (just below the S2 Mid Pivot) / 0.009306 (just below the S2 Pivot)

Short entries – 0.009328 (just above the 100 SMA) / 0.009339 (just below the S1 Mid Pivot)

Notes: Report came in higher than the forecast by only 1.4 points causing a dull 3 tick short spike after 96 sec as it tested the area of support near the LOD and S2 Mid Pivot, but did not have the impulse and momentum to break through, so it retreated 4 ticks after 1 more min. This would have missed you inner long entry and shown no real movement, so cancel the order. After the initial reversal, it continued to climb for another 12 ticks in the next 20 min, crossing the 200 SMA. Then it pulled back 17 ticks in 27 min to reach the LOD. After that it traded sideways between the S1 Pivot and LOD.