3/13/2013 Monthly Retail Sales (0830 EDT)

Core Forecast: 0.5%

Core Actual: 1.0%

Previous revision: +0.2% to 0.4%

Regular Forecast: 0.5%

Regular Actual: 1.1%

Previous Revision: +0.1% to 0.2%

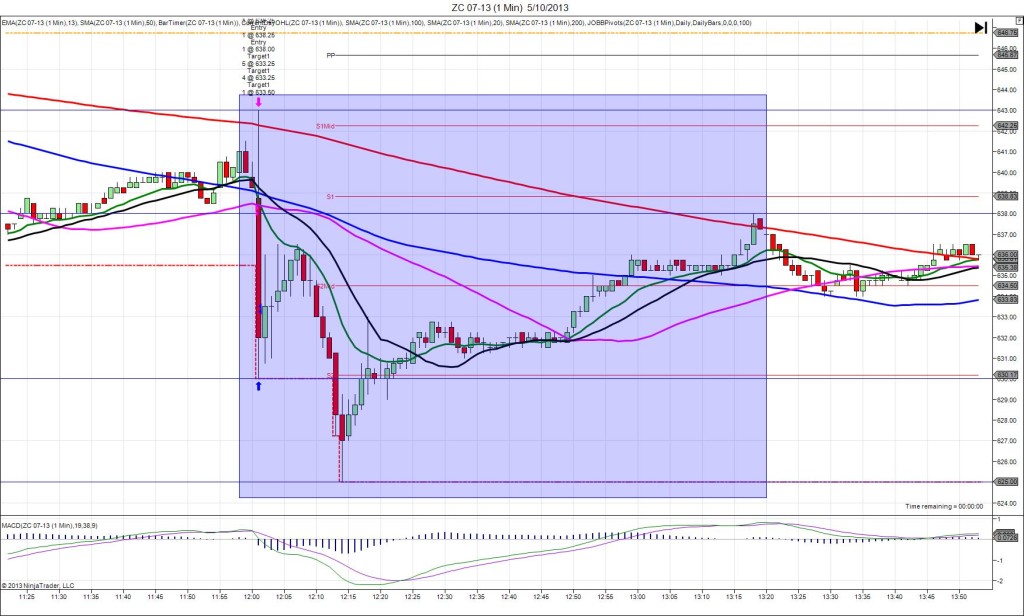

SPIKE WITH 2ND PEAK

Started @ 0.010447

1st Peak @ 0.010410 – 0831 (1 min)

37 ticks

Reversal to 0.010441 – 0843 (13 min)

31 ticks

2nd Peak @ 0.010393 – 0946 (76 min)

54 ticks

Reversal to 0.010422 – 1006 (96 min)

29 ticks

Notes: Report strongly exceeded the forecast on all fronts. This caused a short spike of 37 ticks on the :31 bar that reached the S1 Mid Pivot and the LOD. With JOBB, you would have filled short at 0.010441 with 2 ticks of slippage. After it smashed through the PP Pivot and OOD, stay in and see where it settles. Then look to exit near the LOD with 25+ ticks. After the peak, it achieved a double bottom 5 min later, then reversed for 31 ticks back to the 50 SMA. Then it stepped lower for a slow developing 2nd peak of 54 ticks in the next hr, eclipsing the S1 Pivot. After that it reversed back up to the 100 SMA and OOD for 29 ticks in 20 min.