10/14/2015 Monthly Unemployment Report (2030 EDT)

Employment Change Forecast: 7.2K

Employment Change Actual: -5.1K

Previous Revision: +0.7K to 18.1K

Rate Forecast: 6.2%

Rate Actual: 6.2%

Previous Revision: n/a

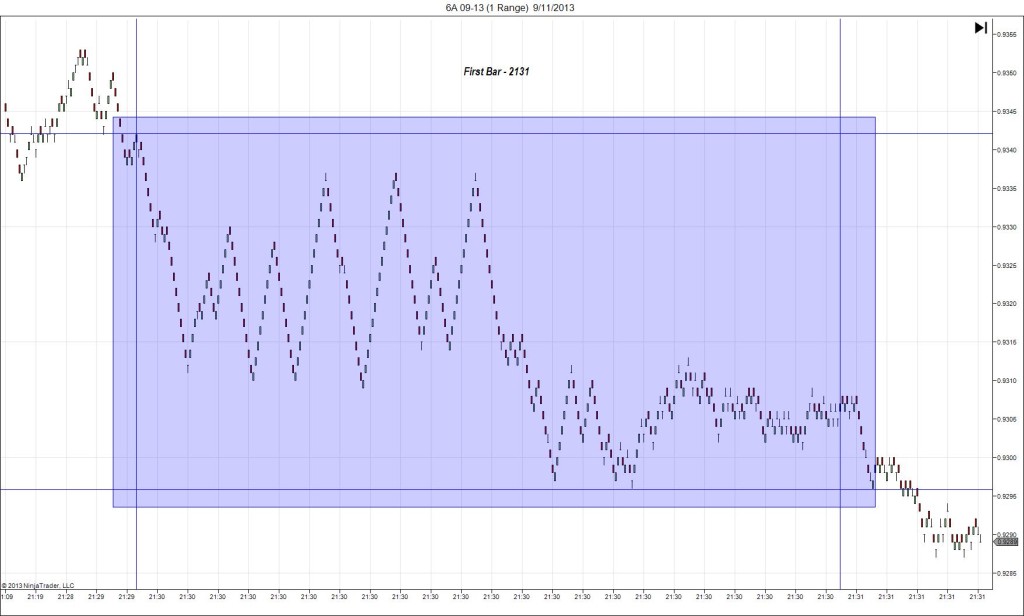

SPIKE WITH 2ND PEAK

Started @ 0.7319

1st Peak @ 0.7280 – 2130:04 (1 min)

39 ticks

Reversal to 0.7295 – 2048 (18 min)

19 ticks

2nd Peak @ 0.7275 – 2103 (33 min)

44 ticks

Reversal to 0.7306 – 2123 (53 min)

31 ticks

Continued Reversal to 0.7329 – 2237 (67 min)

54 ticks

Expected Fill: 0.7306 (short)

Slippage: 5 ticks

Best Initial Exit: 0.7281 – 25 ticks

Recommended Profit Target placement: 0.7282 (just below the R1 Pivot) – move lower to just below the S2 Pivot.