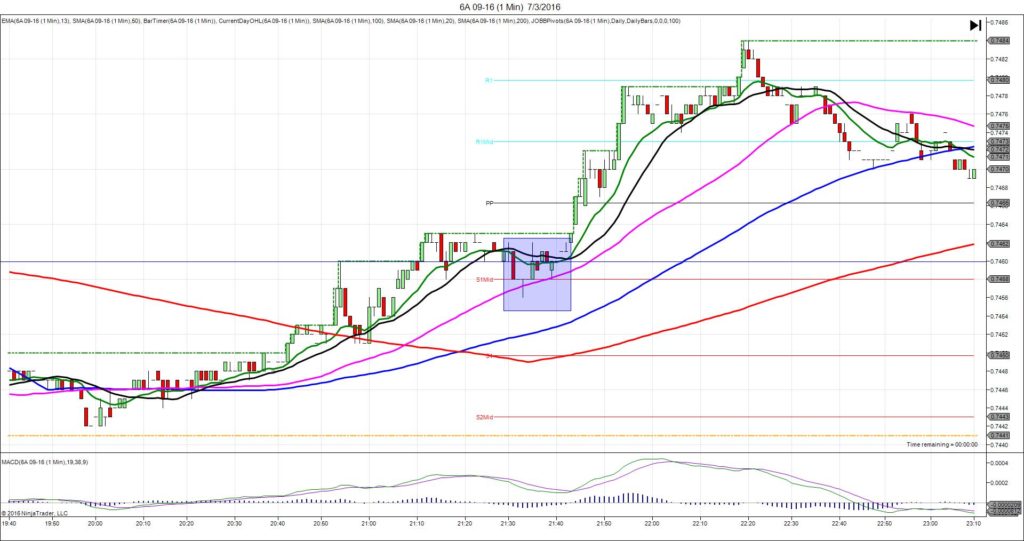

7/3/2015 Building Approvals (1930 EST)

Forecast: -3.6%

Actual: -5.2%

Previous Revision: +0.3% to 3.3%

DULL NO FILL

Started @ 0.7460

1st Bar Span

0.7458 to 0.7461 – +1/-2 ticks – 2131

Notes: Cancel after 10 sec with no fill.

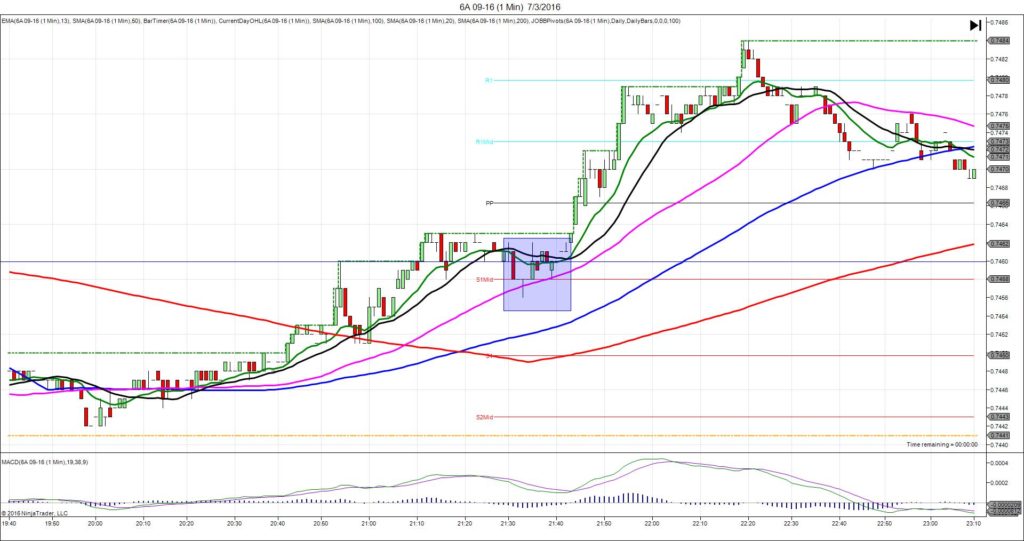

7/3/2015 Building Approvals (1930 EST)

Forecast: -3.6%

Actual: -5.2%

Previous Revision: +0.3% to 3.3%

DULL NO FILL

Started @ 0.7460

1st Bar Span

0.7458 to 0.7461 – +1/-2 ticks – 2131

Notes: Cancel after 10 sec with no fill.

5/30/2016 Building Approvals (2130 EDT)

Forecast: -3.1%

Actual: 3.0%

Previous Revision: -0.8% to 2.9%

UPWARD FAN

Started @ 0.7183

1st Peak @ 0.7206 – 2130:23 (1 min)

23 ticks

Final Peak @ 0.7236 – 2212 (42 min)

53 ticks

Reversal to 7231 – 2230 (60 min)

5 ticks

Expected Fill: 0.7187 (long)

Slippage: 1 tick

Best Initial Exit: 0.7205 – 18 ticks

Recommended Profit Target placement: 0.7197 (just above the HOD and R3 Mid Pivot)

Notes: Strong reaction, but not expected. The first peak matched the largest previous reaction we saw. Then it turned into an upward fan using the 13/20 SMAs as support to continue climbing for 42 min.

5/2/2016 Building Approvals (2130 EDT)

Forecast: -1.8%

Actual: 3.7%

Previous Revision: -0.2% to 2.9%

SPIKE / REVERSE

Started @ 0.7658

1st Peak @ 0.7666 – 2130:05 (1 min)

8 ticks

Reversal to 0.7658 – 2130:34 (1 min)

8 ticks

Pullback to 0.7663 – 2132 (2 min)

5 ticks

Expected Fill: 0.7661 (long)

Slippage: 0 ticks

Best Initial Exit: 0.7665 – 4 ticks

Recommended Profit Target placement: 0.7669 (just above the HOD)

Notes: Quick reversal, but it pulled back to hover around the R1 Pivot for a while to offer 2 ticks on a later exit.

4/3/2016 Monthly Retail Sales (2130 EDT)

Rtl Sales

Forecast: 0.4%

Actual: 0.0%

Previous Revision: n/a

TRAP TRADE – DULL FILL

Anchor Point @ 0.7648

————

Trap Trade:

)))1st Peak @ 0.7630 – 2130:12 (1 min)

)))-18 ticks

)))Reversal to 0.7638 – 2130:15 (1 min)

)))8 ticks

)))Pullback to 0.7628 – 2130:48 (1 min)

)))-10 ticks

————

Reversal to 0.7634 – 2132 (32 min)

6 ticks

Final Peak @ 0.7612 – 2147 (17 min)

36 ticks

Reversal to 0.7623 – 2153 (23 min)

11 ticks

Trap Trade Bracket setup:

Long entries – 0.7636 (just above the LOD) / 0.7627 (No SMA / Pivot near)

Short entries – 0.7659 (in between the R1 Mid Pivot / HOD) / 0.7668 (above the R1 Mid Pivot)

Expected Fill: 0.7636 – inner long tier

Best Initial Exit: 0.7636 – breakeven (0.7634 likely worst case)

Recommended Profit Target placement: 0.7642 – in the middle of the 3 major SMAs

Notes: Strongly bearish Rtl sales results overshadowed the mildly bullish Bldg Approvals to cause a decisive short spike with minimal inclination to reverse. This would have been a dull fill as it would have hovered on your fill point for about 20 sec in the middle of the :31 bar then the PP Pivot held it up for a while before it sought a 2nd peak and fell another 16 ticks.

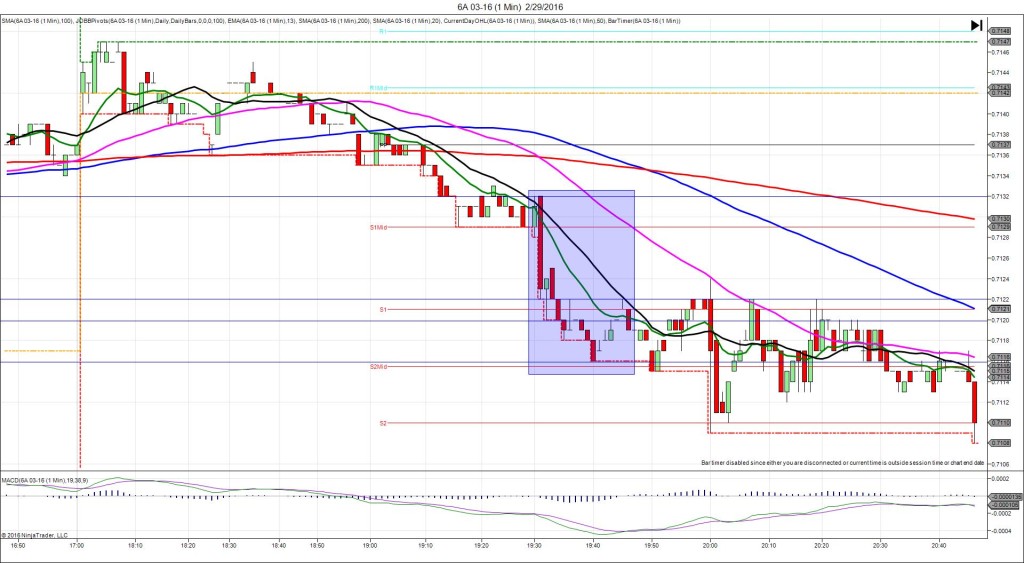

2/29/2015 Building Approvals (1930 EST)

Forecast: -2.9%

Actual: -7.5%

Previous Revision: -0.6% to 8.6%

SPIKE WITH 2ND PEAK

Started @ 0.7132

1st Peak @ 0.7120 – 1931:27 (2 min)

12 ticks

Reversal to 0.7125 – 1933 (3 min)

5 ticks

2nd Peak @ 0.7116 – 1940 (10 min)

16 ticks

Reversal to 0.7122 – 1945 (15 min)

6 ticks

Expected Fill: 0.7128 (short)

Slippage: 1 tick

Best Initial Exit: 0.7121 – 7 ticks

Recommended Profit Target placement: 0.7122 (just above the S1 Pivot)

Notes: 1st peak would have reached the S1 Pivot, then a small reversal followed by a 2nd peak for a few more ticks to the S2 Mid Pivot.

2/2/2016 Monthly Trade Balance (1930 EST)

Forecast: -2.45B

Actual: -3.54B

Previous Revision: +0.18B to -2.73B

TRAP TRADE – INNER TIER

Anchor Point @ 0.7026

————

Trap Trade:

)))1st Peak @ 0.7037 – 1930:03 (1 min)

)))11 ticks

)))Reversal to 0.7018 – 1930:12 (1 min)

)))-19 ticks

————

Continued Reversal to 0.6990 – 1955 (25 min)

47 ticks

Pullback to 0.7005 – 2008 (38 min)

15 ticks

Trap Trade Bracket setup:

Long entries – 0.7019 (in between the S1 Pivot and 50 SMA) / 0.7011 (in between the S2 Mid Pivot and LOD)

Short entries – 0.7033 (just above the S1 Mid Pivot) / 0.7042 (just above the PP Pivot)

Expected Fill: 0.7033 – inner short tier

Best Initial Exit: 0.7019 – 14 ticks (inner long tier)

Recommended Profit Target placement: 0.7019 (inner long tier unmoved)

Notes: Nice conflict with the Trade balance missing the forecast and an equally offsetting Bldg Permits. This caused an ideal whipsaw for the Trap Trade to capture 14 ticks with the inner tiers in 12 sec. After that it continued to fall as the Trade Balance results held sway.

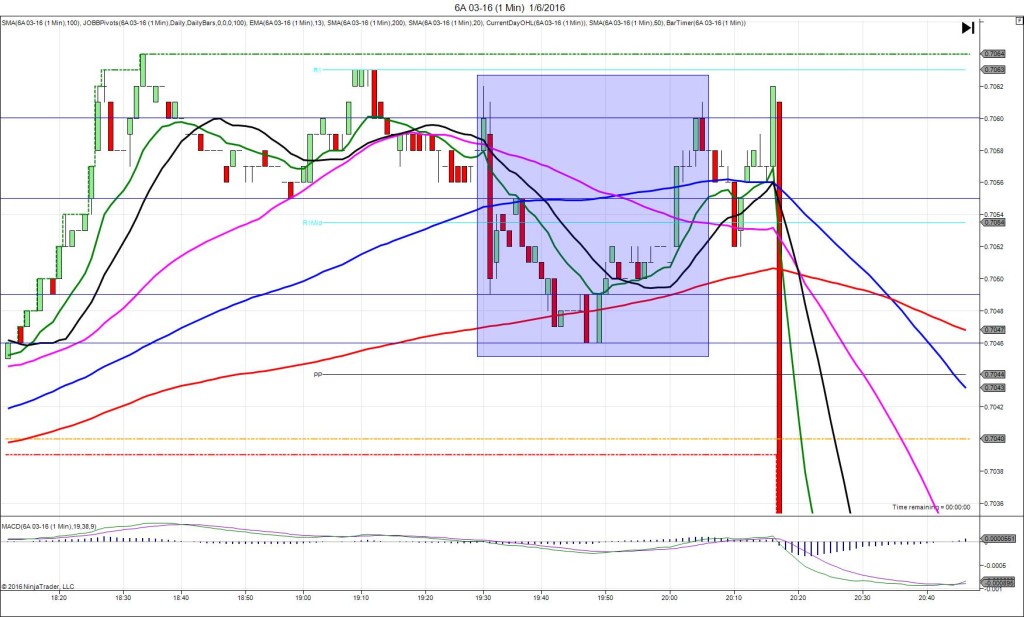

1/6/2016 Monthly Trade Balance (1930 EST)

Forecast: -2.98B

Actual: -2.91B

Previous Revision: +0.06B to -3.25B

TRAP TRADE – DULL FILL

Anchor Point @ 0.7060

————

Trap Trade:

)))1st Peak @ 0.7049 – 1930:24 (1 min)

)))-11 ticks

)))Reversal to 0.7055 – 1930:08 (1 min)

)))6 ticks

)))Pullback to 0.7050 – 1931:02 (2 min)

)))5 ticks

————

Reversal to 0.7055 – 1935 (5 min)

5 ticks

2nd Peak @ 0.7046 – 1947 (17 min)

14 ticks

Reversal to 0.7061 – 2005 (35 min)

15 ticks

Trap Trade Bracket setup:

Long entries – 0.7052 (just below the R1 Mid Pivot) / 0.7045 (in between the 200 SMA / PP Pivot)

Short entries – 0.7067 (just above the HOD) / 0.7076 (just under the R2 Mid Pivot)

Expected Fill: 0.7052 – inner long tier

Best Initial Exit: 0.7054 – 2 ticks

Recommended Profit Target placement: 0.7059 (just above the 50 SMA) – move lower

Notes: Near match on the Trade balance, but a huge miss on the concurrent Building Approvals to cause a decisive short spike. Still would have allowed an exit around breakeven on the positive side.

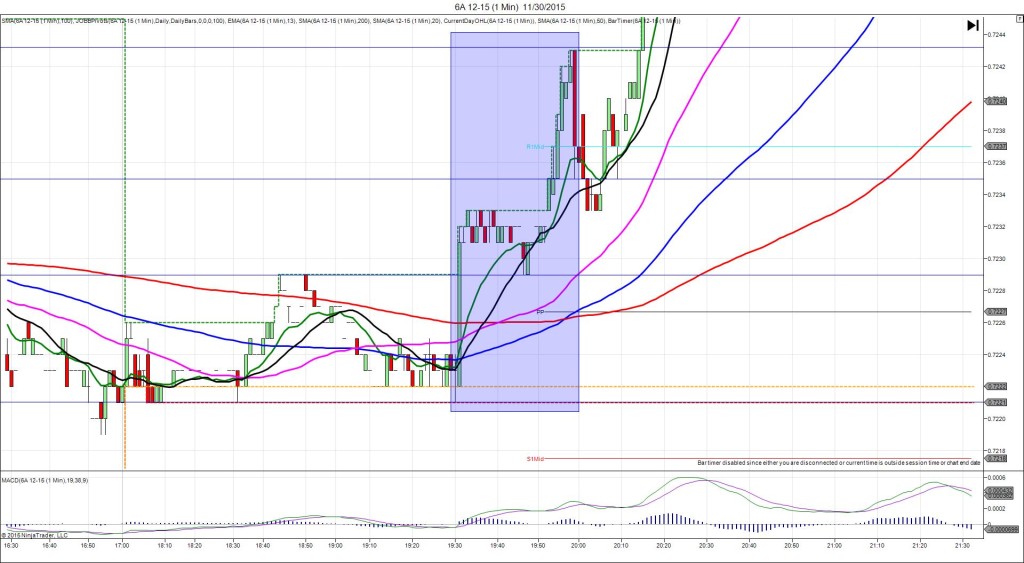

11/30/2015 Building Approvals (1930 EST)

Forecast: -2.4%

Actual: 3.9%

Previous Revision: +0.1% to 2.3%

SPIKE WITH 2ND PEAK

Started @ 0.7221

1st Peak @ 0.7233 – 1932:22 (3 min)

12 ticks

Reversal to 0.7229 – 1946 (16 min)

4 ticks

2nd Peak @ 0.7243 – 1958 (28 min)

22 ticks

Reversal to 0.7235 – 1959 (29 min)

8 ticks

Expected Fill: 0.7224 (long)

Slippage: 0 ticks

Best Initial Exit: 0.7232 – 8 ticks

Recommended Profit Target placement: 0.7236 (below the R1 Mid Pivot) – move down

Notes: The reversal after the 2nd peak was aided by a disappointing CNY manufacturing PMI report.

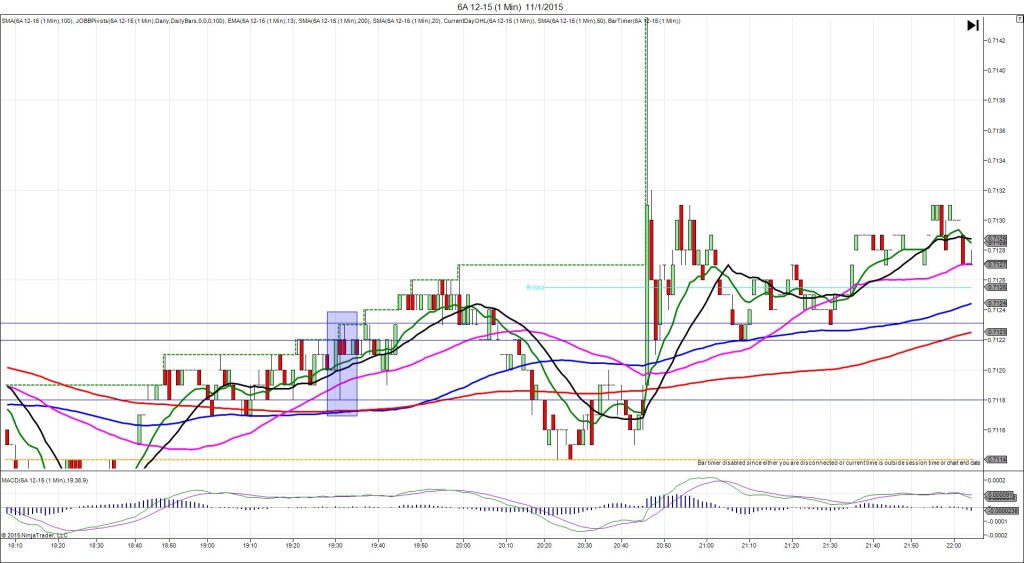

11/1/2015 Building Approvals (1930 EST)

Forecast: 1.8%

Actual: 2.2%

Previous Revision: -2.6% to -9.5%

DULL FILL

Started @ 0.7122

1st Peak @ 0.7118 – 1930:05 (1 min)

4 ticks

Reversal to 0.7123 – 1930:13 (1 min)

5 ticks

Expected Fill: 0.7119 (short)

Slippage: 0 ticks

Best Initial Exit: 0.7120 – 1 tick loss

Recommended Profit Target placement: 0.7110 (above the LOD / PP Pivot) – move up

Notes: Small offset caused a muted reaction of only 4 ticks. Look to exit within 2 ticks of breakeven with the minimal movement.

9/29/2015 Building Approvals (2130 EDT)

Forecast: -1.8%

Actual: -6.9%

Previous Revision: +3.7% to 7.9%

SPIKE WITH 2ND PEAK

Started @ 0.6984

1st Peak @ 0.6974 – 2130:03 (1 min)

10 ticks

Reversal to 0.6982 – 2134 (4 min)

8 ticks

2nd Peak @ 0.6968 – 2213 (43 min)

16 ticks

Reversal to 0.6993 – 2248 (78 min)

25 ticks

Expected Fill: 0.6981 (short)

Slippage: 0 ticks

Best Initial Exit: 0.6975 – 6 ticks

Recommended Profit Target placement: 0.6973 (below the R1 Mid Pivot / 200 SMA) – move up 3 ticks

Notes: Nice 2nd peak opportunity to sell at the 50 / 100 SMAs at 2134 – 5.