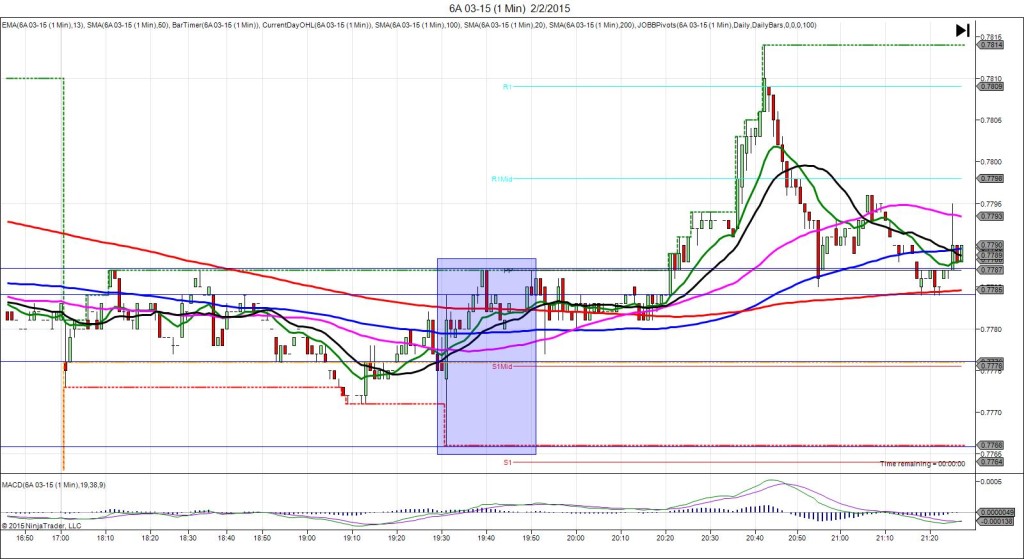

10/1/2014 Monthly Trade Balance (2130 EDT)

Forecast: -0.75B

Actual: -0.79B

Previous Revision: +0.28B to -1.08B

BLDG Permits

Forecast: 1.1%

Actual: 3.0%

Previous Revision: -0.4% to 2.1%

TRAP TRADE – INNER TIER

Anchor Point @ 0.8710 (last price)

————

Trap Trade:

)))1st Peak @ 0.8730 – 2130:16 (1 min)

)))20 ticks

)))Reversal to 0.8717 – 2131:58 (2 min)

)))-13 ticks

————

2nd Peak @ 0.8749 – 2157 (27 min)

39 ticks

Reversal to 0.8732 – 2215 (45 min)

17 ticks

Trap Trade Bracket setup:

Long entry – 0.8695 (No SMA / Pivot near)

Short entry – 0.8725 (No SMA / Pivot near)

Notes: Report basically matched the forecast while the concurrent BLDG Permits report exceeded the forecast by a moderate margin to cause a long spike of 20 ticks initially that started on the 13 SMA and rose to the R2 Pivot. This would have filled your short entry with about 5 ticks to spare, then reversed to allow about 7 ticks to be captured after almost 2 min on the :32 bar as it returned to the R2 Mid Pivot. It chopped sideways near the R2 Mid Pivot for a few min before engaging in a long term rally over the next 1.5 -2 hrs. While the BLDG Permits was the catalyst for the rally, other market factors were the cause of the sustained rally.