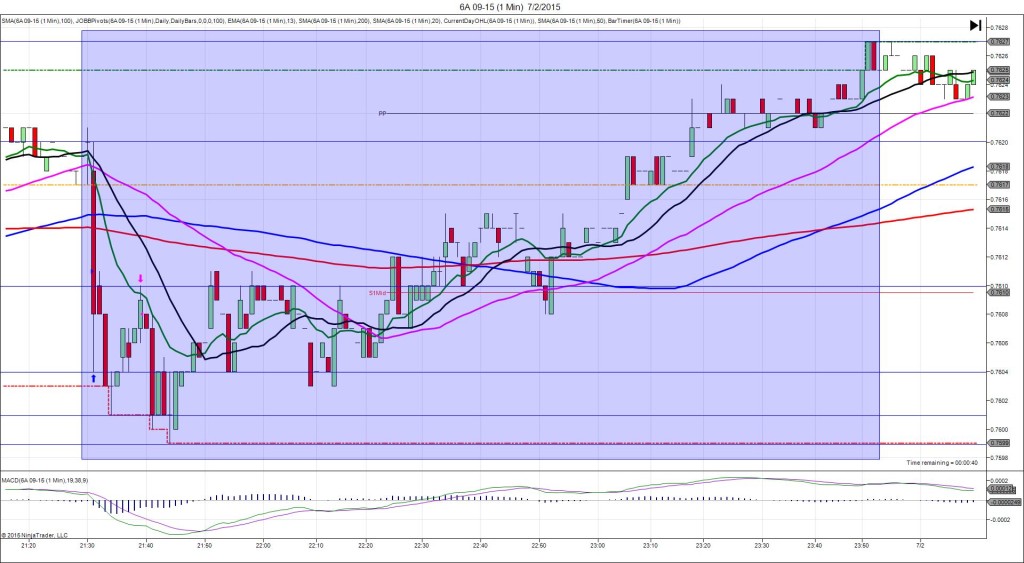

7/1/2015 Monthly Trade Balance (2130 EDT)

Forecast: -2.21B

Actual: -2.75B

Previous Revision: -0.25B to -4.14B

TRAP TRADE – OUTER TIER

Anchor Point @ 0.7620

————

Trap Trade:

)))1st Peak @ 0.7604 – 2130:11 (1 min)

)))-16 ticks

)))Reversal to 0.7611 – 2131:10 (2 min)

)))7 ticks

————

Pullback to 0.7601 – 2134 (4 min)

10 ticks

Reversal to 0.7610 – 2139 (9 min)

9 ticks

2nd Peak @ 0.7599 – 2144 (14 min)

21 ticks

Reversal to 0.7611 – 2151 (21 min)

12 ticks

Continued Reversal to 0.7627 – 2351 (151 min)

28 ticks

Trap Trade Bracket setup:

Long entries – 0.7611 (just above the S1 Mid Pivot) / 0.7604 (just above the LOD)

Short entries – 0.7628 (just below the R1 Mid Pivot) / 0.7636 (just below the R1 Pivot)

Notes: Report fell short of the forecast by 0.54B with a moderate downward revision to the previous report. This caused a short spike of 16 ticks in 11 sec that crossed all 3 Major SMAs, the S1 Mid Pivot and reached the LOD then reversed. This would have filled the inner long entry after 8 sec and the outer tier (if placed at 0.7604 or higher) 3 sec later making 0.76075 your average long position. Due to the consistent bearish news, do not wait for a strong reversal and look to exit quickly when it retreated to the S1 Mid Pivot at 0.7610 for 5 total ticks. After that it pulled back 10 ticks in 2 min before reversing 9 ticks in 5 min to the S1 Mid Pivot / 13 SMA. Then it fell for a 2nd peak of 2 more ticks in 5 min before reversing 12 ticks in 7 min. It continued to climb another 16 ticks slowly in 2 hrs as it crossed the PP Pivot and extended the HOD.