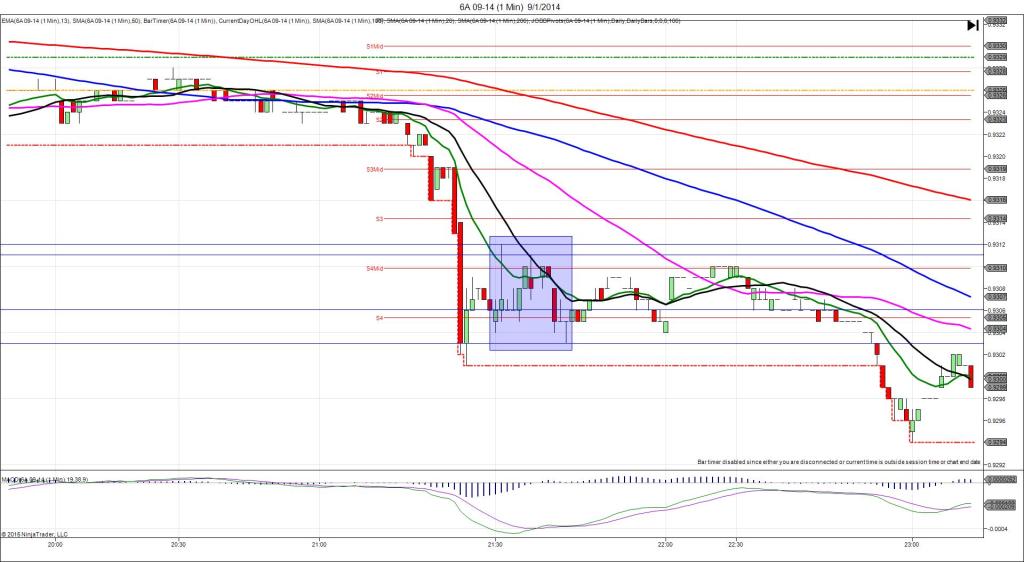

10/1/2014 Building Approvals (2130 EDT)

Forecast: 1.1%

Actual: 3.0%

Previous Revision: -0.4% to 2.1%

SPIKE WITH 2ND PEAK

Started @ 0.8711

1st Peak @ 0.8730 – 2130:19 (1 min)

19 ticks

Reversal to 0.8717 – 2132 (2 min)

13 ticks

2nd peak @ 0.8749 – 2157 (27 min)

38 ticks

Reversal to 0.8732 – 2215 (45 min)

17 ticks

Final Peak @ 8771 – 2310 (100 min)

60 ticks

Reversal to 0.8757 – 2325 (115 min)

14 ticks

Notes: Report came in mildly stronger with 1.9% deviation, with a small downward previous revision. It was also released concurrently with a near matching Trade Balance report. This caused a 19 tick long spike in 19 sec that started on the 13 SMA and rose to reach the R2 Pivot and extend the HOD. With JOBB and a 3 tick bracket, your long order would have filled at about 0.8716 with 2 ticks of slippage, then climbed in a choppy manner to the R2 Pivot before retreating. It made a secondary rally later in the bar and hovered at 0.8728 for about 20 sec to allow an exit with 12 ticks. After that it reversed 13 ticks in 1 min to the original HOD position. Then it engaged in a long term stepping rally, eventually reaching a final peak of 41 more ticks after 108 min after eclipsing the R3 Mid Pivot. Then it reversed 14 ticks in 15 min to the R3 Mid Pivot and 50 SMA.