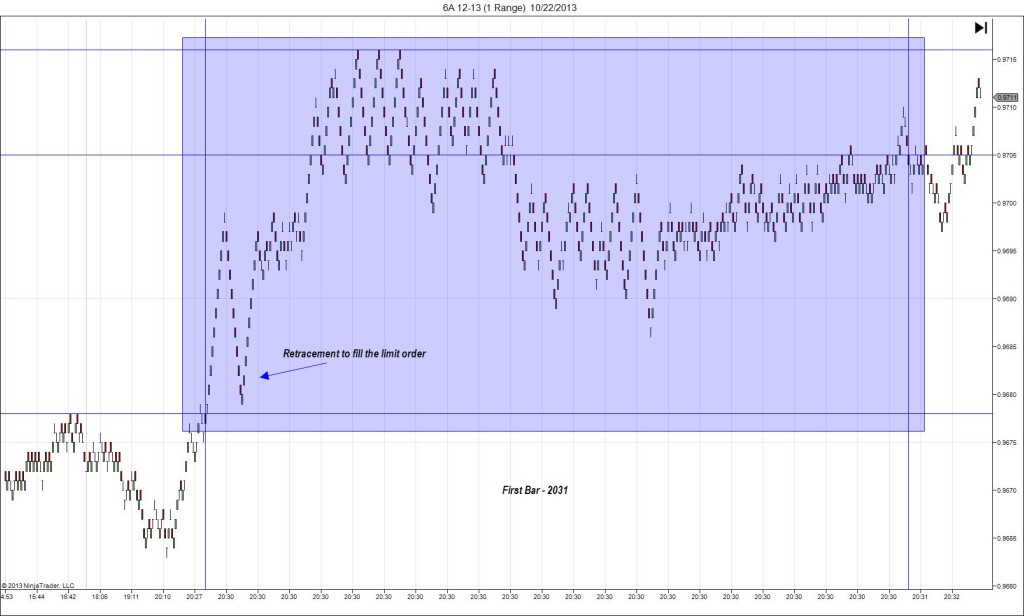

10/22/2013 Quarterly CPI (2030 EDT)

Forecast: 0.8%

Actual: 1.2%

Previous Revision: n/a

SPIKE/REVERSE

Started @ 0.9678

1st Peak@ 0.9716 – 2031 (1 min)

38 ticks

Reversal to 0.9697 – 2033 (3 min)

19 ticks

Notes: This report was strongly positive, exceeding the forecast by 0.4%. This resulted in a quick choppy long spike of 38 ticks that crossed the R1 Pivot and fell short of the R2 Mid Pivot on the :31 bar. With JOBB and the recommended limit order setting, you would have filled long at 0.9685 and avoided 12 ticks of slippage that would have been seen with stop orders. This is due to the retracement after the initial burst back to 0.9879. Look to exit at about 0.9710 for 25 ticks when it hovered for 9 sec between 0.9702 and 0.9716. If you waited you still could have captured about 10-15 ticks later in the bar. After the peak, it reversed for 19 ticks on the :33 bar, with 11 ticks of the retreat gained on the naked wick of the :31 bar. After that it traded sideways for about an hour above the R1 Pivot, but never could make a successful run at a 2nd peak.

-102312.jpg)

-102312.jpg)

-072412.jpg)

-072412.jpg)

-012412.jpg)

-012412.jpg)