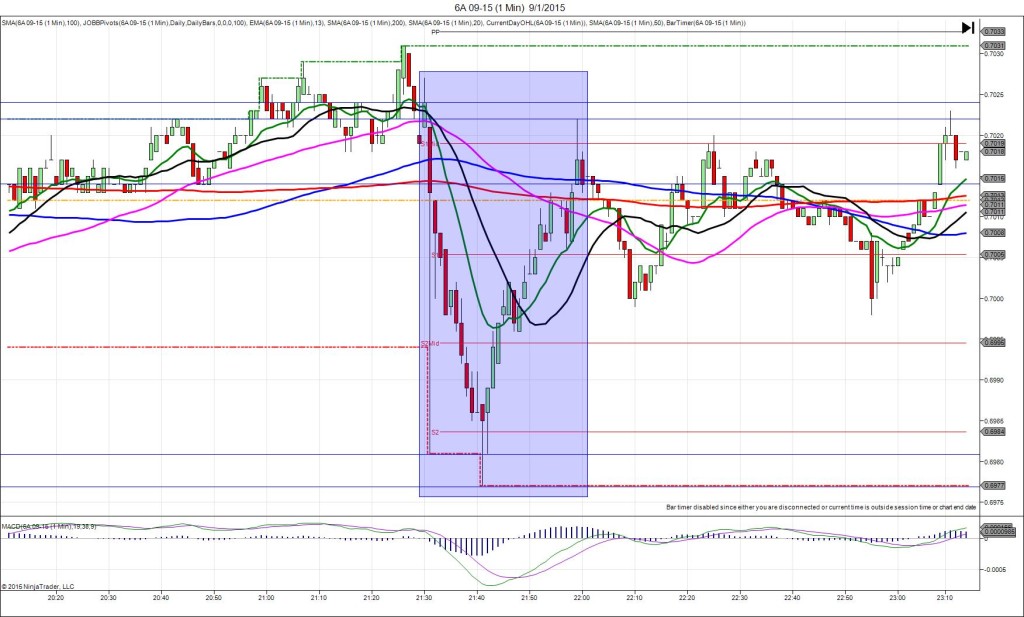

3/1/2016 Quarterly Advance GDP (1930 EST)

Forecast: 0.5%

Actual: 0.6%

Previous Revision: +0.2% to 1.1%

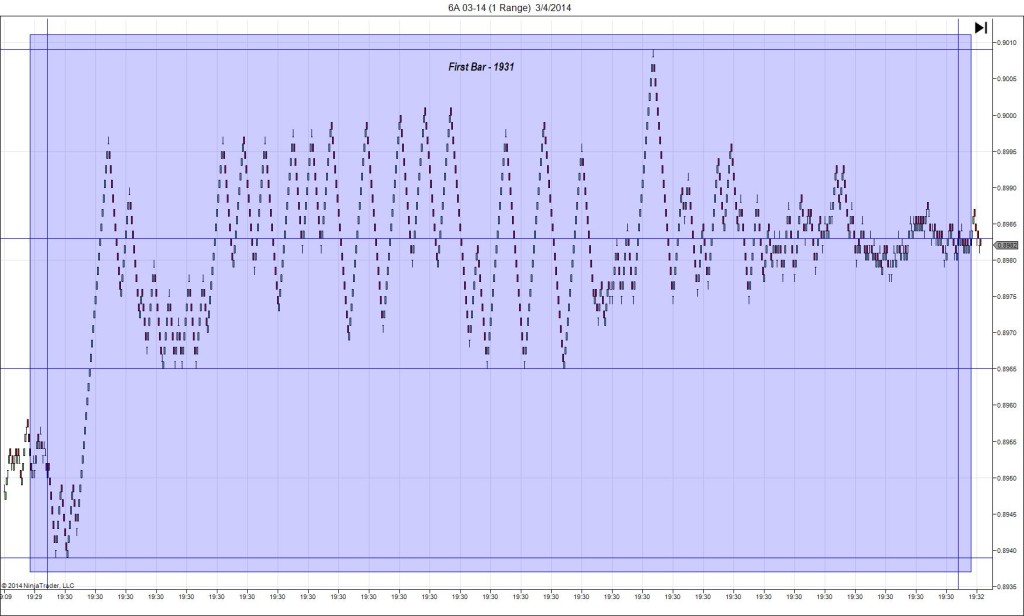

SPIKE WITH 2ND PEAK

Started @ 0.7163

1st Peak @ 0.7208 – 1931:05 (2 min)

45 ticks

Reversal to 0.7201 – 1931:07 (2 min)

7 ticks

2nd Peak @ 0.7232 – 1942 (12 min)

69 ticks

Reversal to 0.7214 – 1952 (22 min)

18 ticks

Expected Fill: 0.7172 (long)

Slippage: 2 ticks

Best Initial Exit: 0.7207 – 35 ticks

Recommended Profit Target placement: 0.7196 (just above the R1 Pivot) and 0.7208 (just above the R2 Mid Pivot)

Notes: A stable setup and low slippage fill on a healthy spike to the R2 Mid Pivot. On these bigger quarterly reports on the 6A, it is okay to be patient for a few more ticks as it will have biased sentiment for a while without wanting to reverse. Here we saw basically continuous upward momentum until the R2 Pivot was reached for the first 4 min. Then it achieved a 2nd peak a few min later and settled into a sideways channel. Not advisable to trade reversals on these trades.