9/14/2015 RBA Monetary Policy Meeting Minutes (2130 EDT)

Forecast: n/a

Actual: n/a

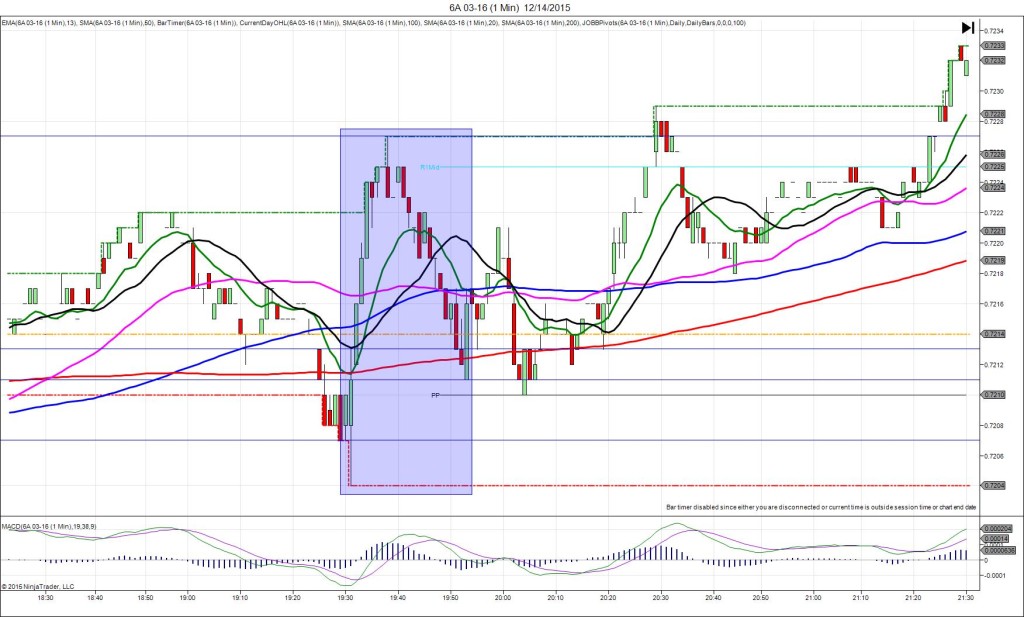

TRAP TRADE – DULL NO FILL

Anchor Pt @ 0.7114 – shift up 2 ticks to 0.7116

—————-

Trap Trade:

)))1st peak @ 0.7096 – 2131:08 (2 min)

)))-18 ticks

)))Reversal to 0.7107 – 2131:54 (2 min)

)))11 ticks

—————-

2nd Peak @ 0.7089 – 2138 (8 min)

25 ticks

Reversal to 0.7101 – 2147 (17 min)

12 ticks

Trap Trade Bracket setup:

Long entries – 0.7109 (just below the R1 Mid Pivot / 0.7100 – just below the PP Pivot)

Short entry – 0.7123 (just above the R1 Pivot / 0.7131 (in between the R2 Mid Pivot / HOD)

Expected Fill: n/a – cancel

Best Initial Exit: n/a

Recommended Profit Target placement: n/a

Notes: Slow and delayed reaction that did not really launch until over 1 min after the release. Cancel the order.