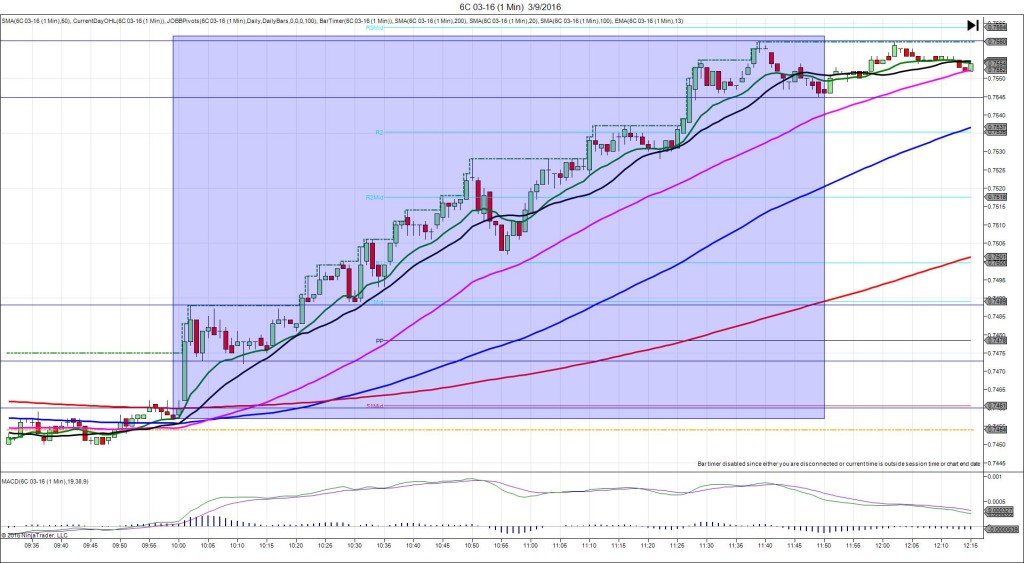

4/13/2016 BOC Rate Statement / Overnight Rate (1000 EDT)

Forecast: 0.50%

Actual: 0.50%

Previous Revision: n/a

TRAP TRADE – INNER TIER

Anchor Point @ 0.7816

—————-

Trap Trade:

))) 1st peak @ 0.7836 – 1000:03 (1 min)

)))20 ticks

)))Reversal to 0.7802 – 1000:35 (1 min)

)))-34 ticks

)))Pullback to 0.7818 – 1000:53 (1 min)

)))16 ticks

)))Reversal to 0.7804 – 1001:23 (2 min)

)))-14 ticks

—————-

2nd Peak @ 0.7848 – 1009 (9 min)

32 ticks

Reversal to 0.7822 – 1030 (30 min)

26 ticks

Trap Trade Bracket setup:

Long entries – 0.7800 (just above the LOD) / 0.7791 (No SMA / Pivot near)

Short entries – 0.7833 (on the OOD) / 0.7843 (just below the R1 Mid Pivot / HOD)

Expected Fill: 0.7833 – inner short tier

Best Initial Exit: 0.7803 – 30 ticks

Recommended Profit Target placement: 0.7811 (just below the 200 SMA / PP Pivot)

Notes: The BOC maintained the status quo. This caused a nice slow whipsaw to fill the inner short tier then collapse to just above the LOD 32 sec later. This would have allowed at least 20 ticks to be captured with a little patience and a well placed profit target. After that it climbed for a 2nd peak of 12 more ticks to eclipse the R1 Mid Pivot / HOD, then reversed 26 ticks heading into the oil inventory report.