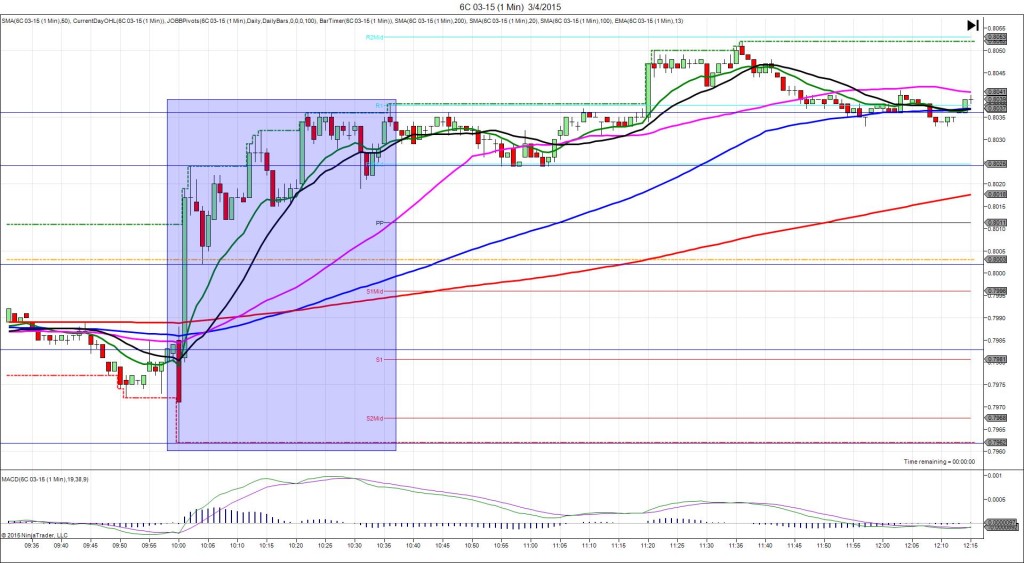

3/4/2015 BOC Rate Statement / Overnight Rate (1000 EST)

Forecast: 0.75%

Actual: 0.75%

Previous Revision: n/a

TRAP TRADE – INNER TIER

Anchor Point @ 0.7983

—————-

Trap Trade:

)))1st peak @ 0.7962 – 0959:59 (1 min)

)))-21 ticks

)))Reversal to 0.8024 – 1001:25 (1 min)

)))62 ticks

—————-

Pullback to 0.8002 – 1004 (4 min)

22 ticks

Reversal to 0.8036 – 1022 (22 min)

34 ticks

Trap Trade Bracket setup:

Long entries – 0.7966 (just below the S2 Mid Pivot) / 0.7958 (in between the S2 Pivot / LOD)

Short entries – 0.7999 (in between the S1 Mid Pivot / OOD) / 0.8010 (just below the PP Pivot)

Notes: After the surprise rate cut last meeting, the BOC maintained rates at 0.75% and stated CPI inflation has fallen due to the drop in oil prices. This caused a short dip of 21 ticks 1 sec early followed by a reversal of 62 ticks in the next 82 sec. This would have filled your inner long entry with about 4 ticks to spare, then reversed and hit your opposite short entry 1 sec later for about 30-35 ticks. Be sure to cancel the order after the short entry flattens your order with the outer tiers still pending to be safe. If not the outer short entry would have filled after 13 sec, then allowed a handful of ticks to be captured in the next 30 sec before it climbed another 15 ticks (you would have been fortunate on this occasion due to the resistance of the PP Pivot). After that it pulled back 22 ticks in 2 min to the OOD before stepping higher for a 34 tick reversal in 18 min. After that it traded sideways for about an hour and continued to slowly step higher.