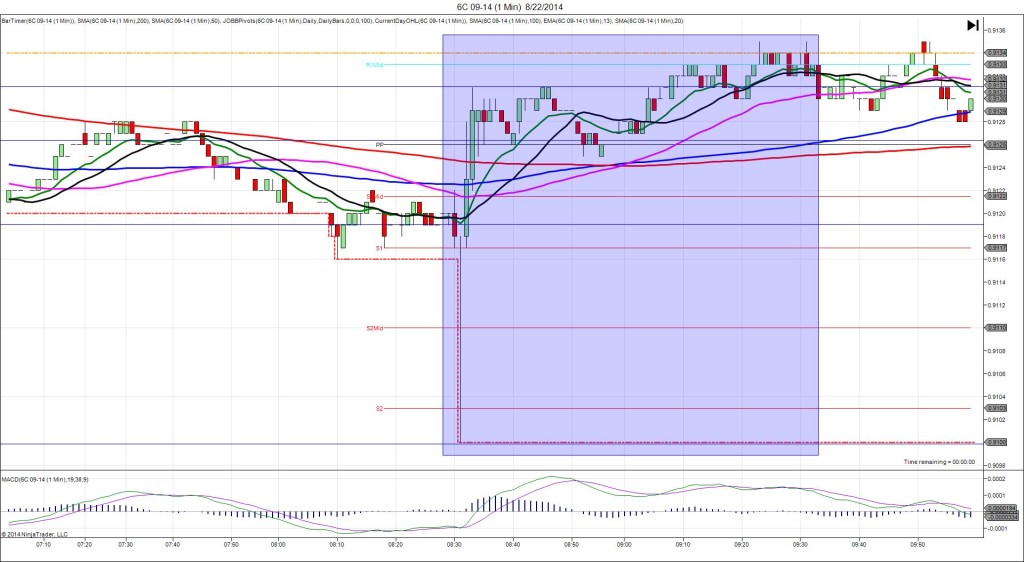

8/22/2014 Monthly Core CPI / CPI Report (0830 EDT)

Core CPI Forecast: 0.1%

Core CPI Actual: -0.1%

Previous Revision: n/a

CPI Forecast: -0.1%

CPI Actual: -0.2%

Previous Revision: n/a

TRAP TRADE – INNER TIER

Anchor Point @ 0.9119 (last price)

—————-

Trap Trade:

)))1st peak @ 0.9100 – 0830:08 (1 min)

)))-19 ticks

)))Reversal to 0.9126 – 0831:06 (1 min)

)))26 ticks

—————-

Pullback to 0.9120 – 0832 (2 min)

6 ticks

Reversal to 0.9131 – 0833 (3 min)

11 ticks

Trap Trade Bracket setup:

Long entry – 0.9101 (just below the S2 Pivot)

Short entry – 0.9139 (just below the R1 Pivot)

Notes: Report fell short of the forecast across the board on the CPI readins, but strongly exceeded the forecast on the concurrently released Retail sales report by 1.1% and 0.8%. This caused a short spike of 19 ticks that eclipsed the S2 Pivot after 8 sec, then a fairly quick reversal of 26 ticks after 1 min that crossed all 3 major SMAs and the PP Pivot. Due to the double booked report, we only recommended the outer tier for this report. The short move would have filled your tier at 0.9101 for an ideal entry with 1 tick of heat, then reversed to give you an opportunity to exit with up to 25 ticks with ease late in the :31 bar. With the very bipolar report, wait for it to at least return to the origin, and test the SMAs before considering exiting the trade. After the reversal, it pulled back for 6 ticks, then rallied another 11 ticks 1 min later. Then it traded sideways.