10/23/2013 BOC Rate Statement / Overnight Rate (1000 EDT)

Forecast: 1.00%

Actual: 1.00%

Previous Revision: n/a

TRAP TRADE

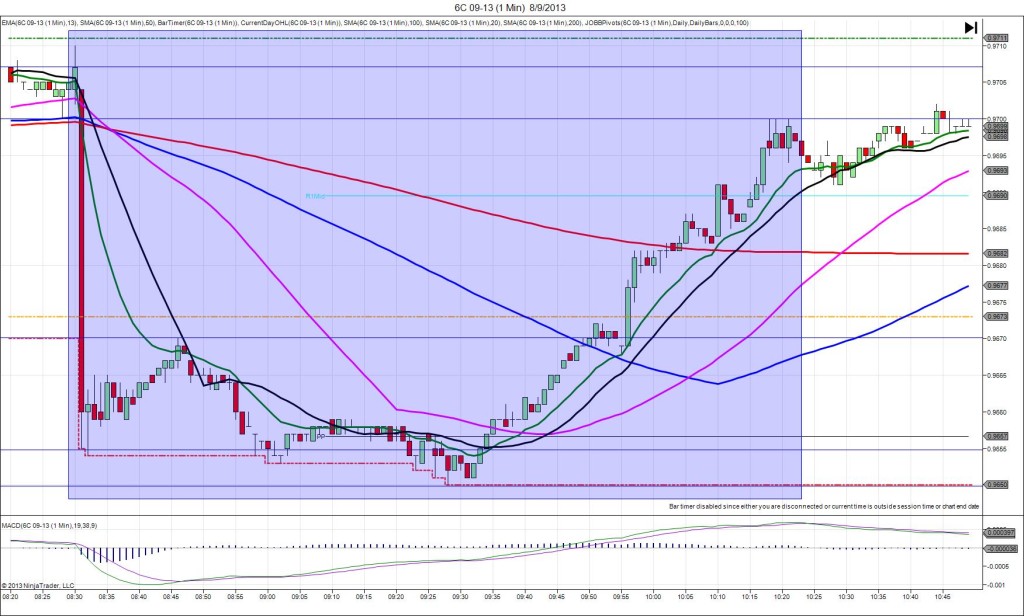

Anchor Point @ 0.9668

—————-

Trap Trade:

)))1st peak @ 0.9680 – 1000:02 (1 min)

)))12 ticks

)))Reversal to 0.9629 – 1000:10 (1 min)

)))-51 ticks

)))Pullback to 0.9648 – 1001:27 (2 min)

)))19 ticks

—————-

Reversal to 0.9607 – 1052 (52 min)

41 ticks

Pullback to 0.9625 – 1131 (91 min)

18 ticks

Notes: The BOC left interest rates unchanged as expected citing that the global economy continues to expand broadly as expected, but left out previous statutory language about the need for future interest rate hikes. This matched the forecast of leaving the rate unchanged, but caused a relatively decisive and short move as it was deciphered as dovish. The initial move long was only about 12 ticks to reach the S2 Mid Pivot, then the following reversal fell to cross all 3 major SMAs and reach the S3 Pivot for a total drop of 51 ticks. A trap trade setup of 20-30 ticks offset with a level of support/resistance was recommended. In this case, use the S2 Pivot at 0.9668 as the anchor point. The S1 Mid Pivot at 0.9698 would be an ideal place for the short entry and about halfway between the S3 Pivot and S3 Mid Pivot at about 0.9638 would be ideal place for the long entry. The reversal would have filled the long entry at 7 sec into the :01 bar, then you would have had 2 opportunities to exit with up to 10 ticks when it retreated to the S3 Mid Pivot while seeing no more than 9 ticks of heat. Not the best setup for the Trap Trade, but this report is the most challenging with little consistency in the size of the reactions. After the :02 bar, it achieved another reversal of 41 ticks to reach the S4 Pivot 50 min later, before giving back 18 ticks in the next 40 min to reach the 100 SMA.