3/27/2013 Monthly Core CPI / CPI Report (0830 EST)

Core CPI Forecast: 0.3%

Core CPI Actual: 0.8%

Previous Revision: n/a

CPI Forecast: 0.6%

CPI Actual: 1.2%

Previous Revision: n/a

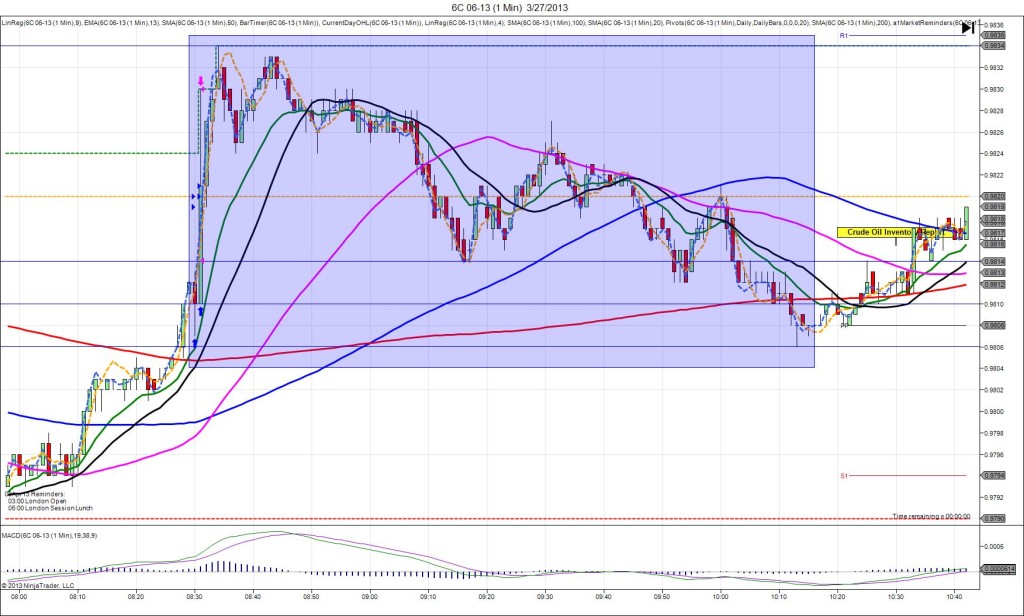

SPIKE/REVERSE

Started @ 0.9810

1st Peak @ 0.9834 – 0834 (4 min)

24 ticks

Reversal to 0.9814 – 0916 (46 min)

20 ticks

Extended Reversal to 0.9806 – 1013 (103 min)

28 ticks

Notes: Report strongly exceeded the forecast on the core reading and the less influential regular CPI reading. With a bearish market before the report that had begun to correct, the market sentiment was fairly neutral and trading just above the PP pivot and 200 SMA. This caused a 24 tick spike that initially eclipsed the HOD and extended it 10 ticks. The :31 bar saw a decent pullback, but the next 3 bars saw it nearly reach the R1 Pivot. With JOBB you would have filled long at 0.9820 with 5 ticks of slippage, then seen it pop up and give you a brief opportunity at 8-10 ticks. Otherwise, if you had waited you could have gotten out on the following 3 bars with slightly more ticks. After the peak, it fell, but tried for a 2nd peak. Failing to go any higher, it reversed in the next 30 min to cross the 50 and nearly reach the 100 SMA. The extended reversal saw 8 ticks more to reach the PP Pivot 1 hour later.

-120412.jpg)

-102312.jpg)

-101912.jpg)

-092112.jpg)