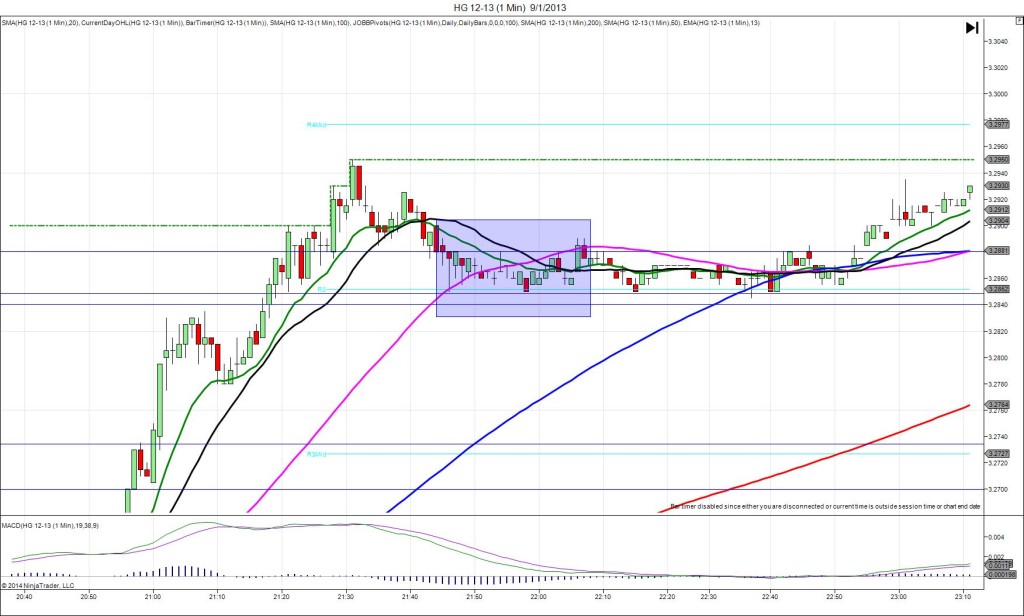

3/31/2016 CNY Caixin Flash Manufacturing PMI (2145 EDT)

Forecast: 48.3

Actual: 49.7

Previous Revision: n/a

SPIKE / REVERSE

Started @ 2052.00

1st Peak @ 2054.00 – 2145:00 (1 min)

8 ticks

Reversal to 2050.50 – 2145:48 (1 min)

14 ticks

Pullback to 2051.75 – 2147 (2 min)

5 ticks

Reversal to 2047.75 – 2211 (26 min)

16 ticks

Expected Fill: 2052.75

Slippage: 0 ticks

Best Initial Exit: 2054.00 – 5 ticks

Recommended Profit Target placement: 2054.50 (just above the PP Pivot) – move lower

Notes: Small and unsustained spike for the size of the offset. As it was bucking the short trend after the CNY manufacturing report and ran into the PP Pivot, it collapsed on the back end of the :46 bar. If you are still open and you see it start to retreat from the PP Pivot, be careful and exit or move the stop up to the 50 SMA area. After that it reversed for 14 ticks, then 16 ticks after a small pullback.