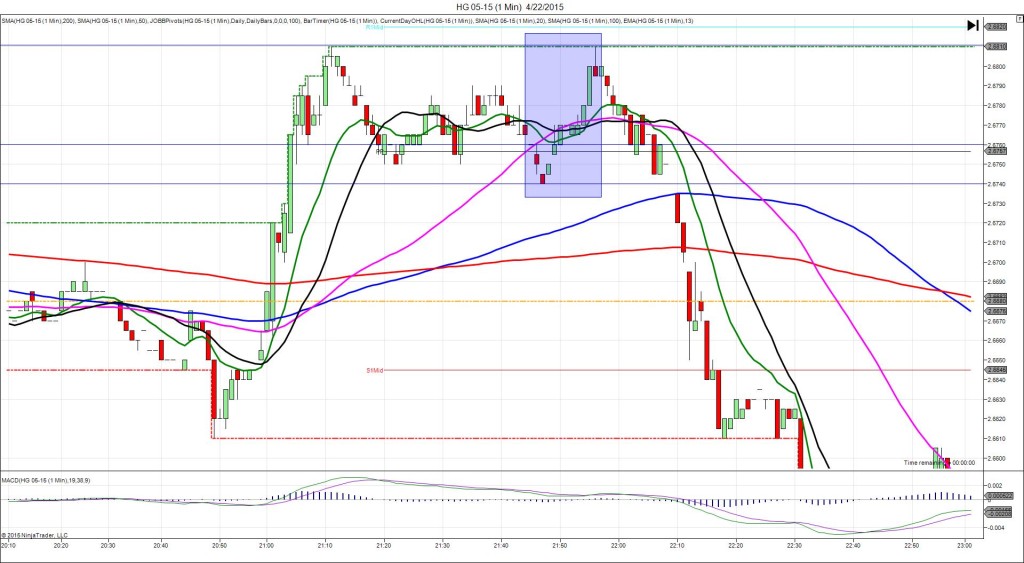

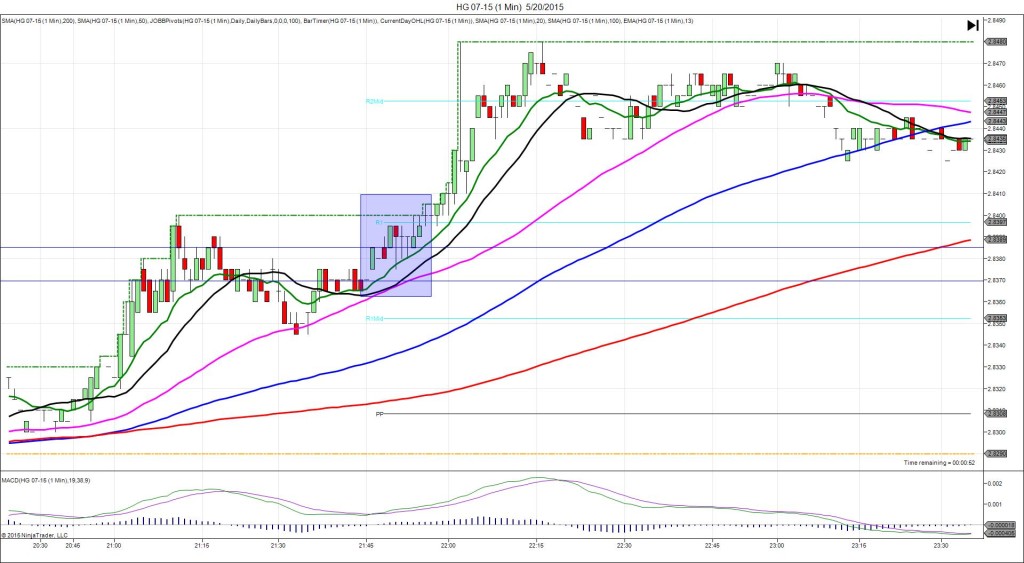

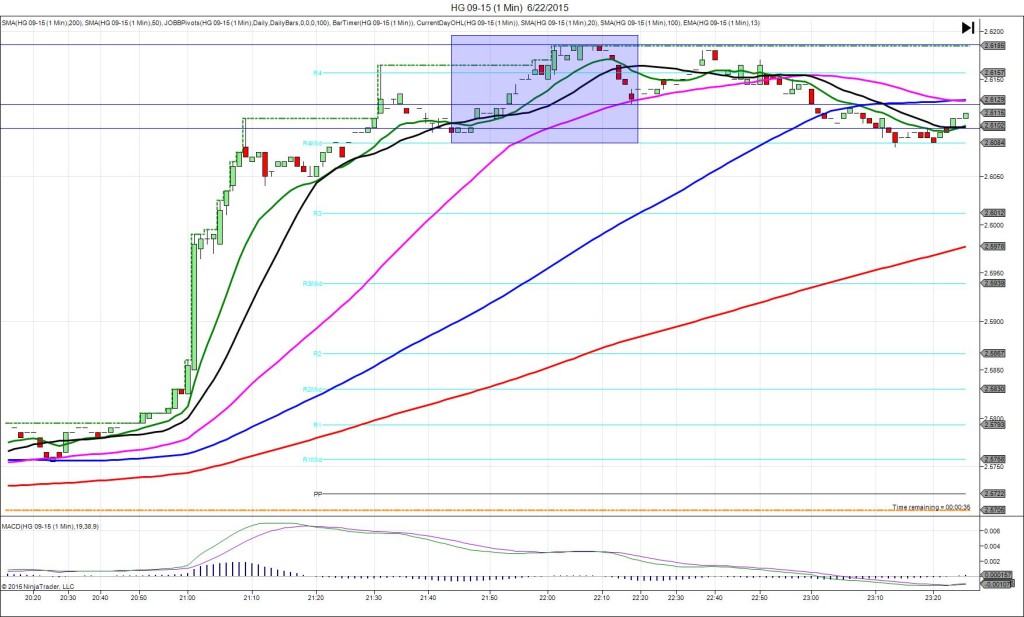

9/22/2014 CNY HSBC Flash Manufacturing PMI (2145 EDT)

Forecast: 50.0

Actual: 50.5

Previous Revision: -0.1 to 50.2

SPIKE WITH 2ND PEAK

Started @ 3.0470

1st Peak @ 3.0570 – 2147 (2 min)

20 ticks

Reversal to 3.0515 – 2149 (4 min)

11 ticks

2nd Peak @ 3.0620 – 2201 (16 min)

30 ticks

Reversal to 3.0565 – 2207 (22 min)

11 ticks

Extended Reversal to 3.0515 – 2300 (75 min)

21 ticks

Notes: Report impressed the traders with a negligible previous report downward revision. This caused a healthy long spike that started on the 50 SMA ascending an upward trend and rose to cross the R2 Pivot in 2 bars and extend the HOD. With JOBB, your long order would have filled at about 3.0490 with 1 tick of slippage. Then it would have given you an opportunity to exit with up to 14 ticks on the :47 bar as it penetrated the R2 Pivot. As noted many times before this report is safe to wait for a peak after 1 min. After the peak, it reversed 11 ticks to the R2 Mid Pivot in 2 min. Then it climbed for a 2nd peak of 10 more ticks in the next 12 min, presenting a perfect buy opportunity above the R2 Mid Pivot. It would have allowed you to capture up to 20 ticks. Then it reversed back to the R2 Pivot in 6 min for 11 ticks, and followed with another 10 ticks to the R2 Mid Pivot in the next 53 min.

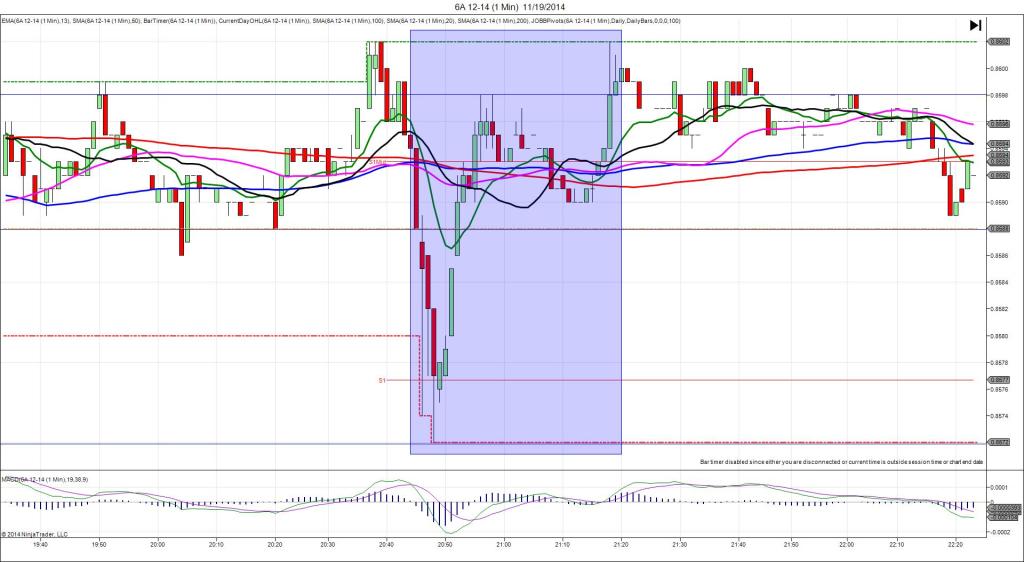

We also recommended the 6A as an alternative to the HG with limit orders using 10 as the slippage setting. It saw a long spike of 19 ticks that would have filled with 5 ticks of slippage. As the peak was shortly sustained, the most likely scenario would have been an ext with 4-6 ticks. It would have allowed a good reversal trade opportunity as it hovered just above the R2 Pivot and then fell 12 ticks on 2 occasions allowing about 10 ticks to be captured. After achieving a double top, it reversed 26 ticks in 22 min as it crossed the R1 Mid Pivot.