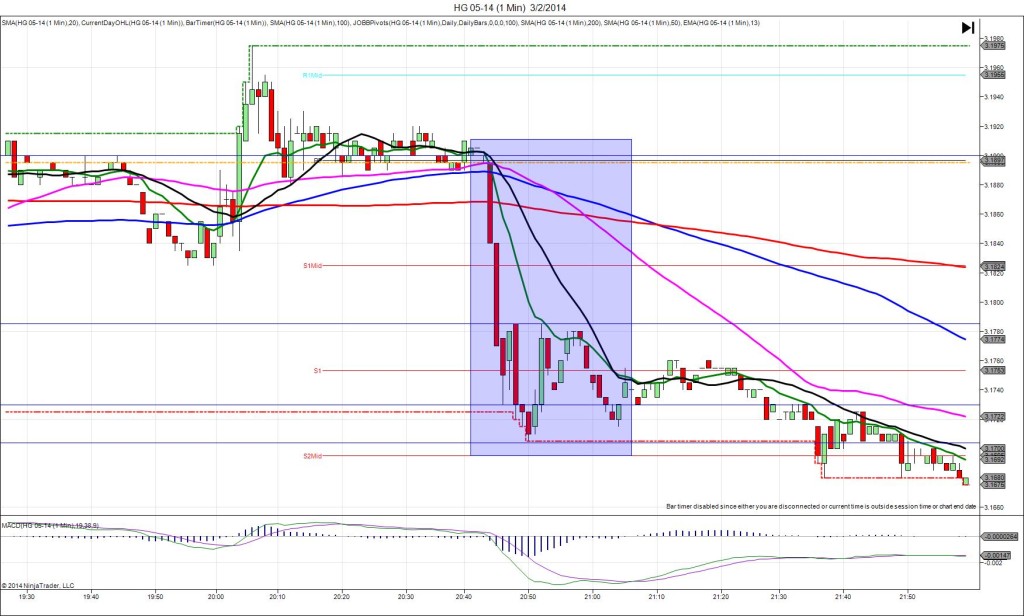

12/1/2013 CNY HSBC Final Manufacturing PMI (2045 EDT)

Forecast: 50.5

Actual: 50.8

DULL REACTION…SPIKE WITH 2ND PEAK

Started @ 3.2040

1st Peak @ 3.2065 – 2046 (1 min)

5 ticks

Final Peak @ 3.2150 – 2104 (19 min)

22 ticks

Reversal to 3.2040 – 2123 (38 min)

22 ticks

Extended Reversal to 3.1965 – 2208 (83 min)

37 ticks

Notes: Report exceeded the forecast by 0.3 pts, causing a small long spike of 5 ticks that started on the 13/20 SMAs, then only rose to cross the 100/200 SMAs on the :46 bars. With the tame move on the :46 bar, it would be safe and conservative to exit on 100/200 SMAs, but knowing the average reaction is larger, you can patiently wait for more ticks on a later move. After the :46 bar it struggled with the 100/200 SMAs for 4 more mine, then ascended for 17 more ticks in the next 14 min, crossing the PP Pivot and extending the HOD. It nearly reached the R1 Mid Pivot before reversing 22 ticks in the next 19 min back to the origin. Then after a brief pullback, it continued to reverse for another 15 ticks in the next 45 min, crossing the S1 Mid Pivot and extending the LOD.