2/20/2014 French Flash Manufacturing PMI (0300 EST)

Forecast: 49.6

Actual: 48.5

Previous Revision: +0.5 to 49.3

Services PMI

Forecast: 49.5

Actual: 46.9

Previous Revision: +0.3 to 48.9

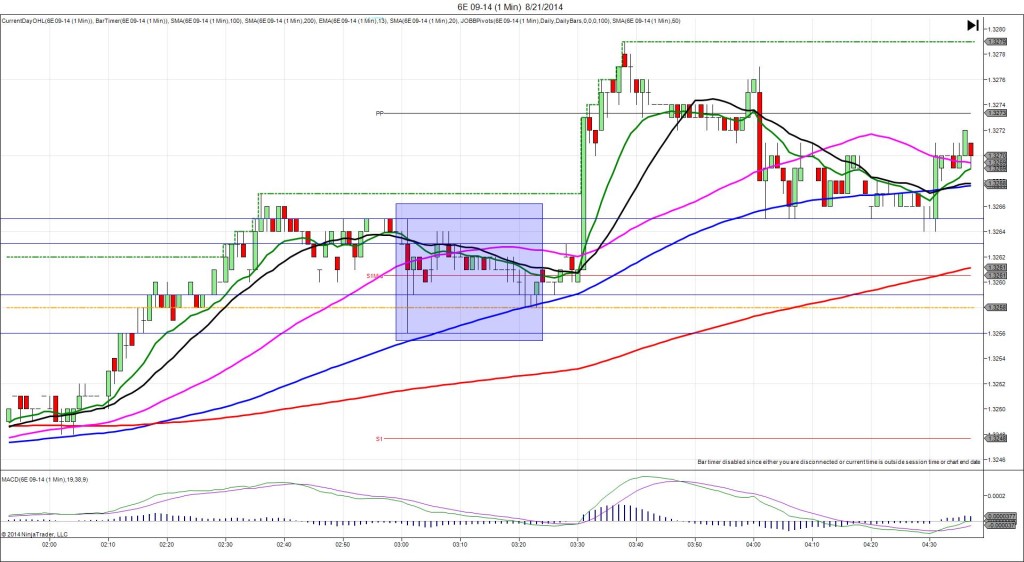

SPIKE WITH 2ND PEAK

Started @ 1.3732 (0258)

1st Peak @ 1.3706 – 0259 (1 min)

26 ticks

Reversal to 1.3717 – 0303 (5 min)

11 ticks

2nd Peak @ 1.3699 – 0324 (26 min)

33 ticks

Reversal to 1.3707 – 0328 (30 min)

8 ticks

Notes: Report breaks 2 min early at 0258. The manufacturing reading came in 1.1 points below the forecast to disappoint with a modest upward revision on the previous report, and the simultaneous Services reading came in 2.6 points below the forecast with a negligible upward revision. All of this served to cause a healthy short spike of 26 ticks on the :59 bar that started just underneath the S1 Mid Pivot and 13 SMA then crossed the S2 Mid Pivot and almost reached the S2 Pivot while extended the LOD. With JOBB you would have filled short at about 1.3714 with abnormally high 15 ticks of slippage then seen it hover between 3 ticks of heat and 7 ticks of profit for the rest of the bar. After the opening few seconds, move the profit target to about 1.3708 after seeing it hit the 1.3706 area several times without penetrating. After the reversal achieved an 11 tick rebound in the next 4 bars back to the S2 Mid Pivot, it fell for a 2nd peak of 7 more ticks 20 min later, crossing the S2 Pivot. Then it pulled back for 8 ticks just before the German report release.