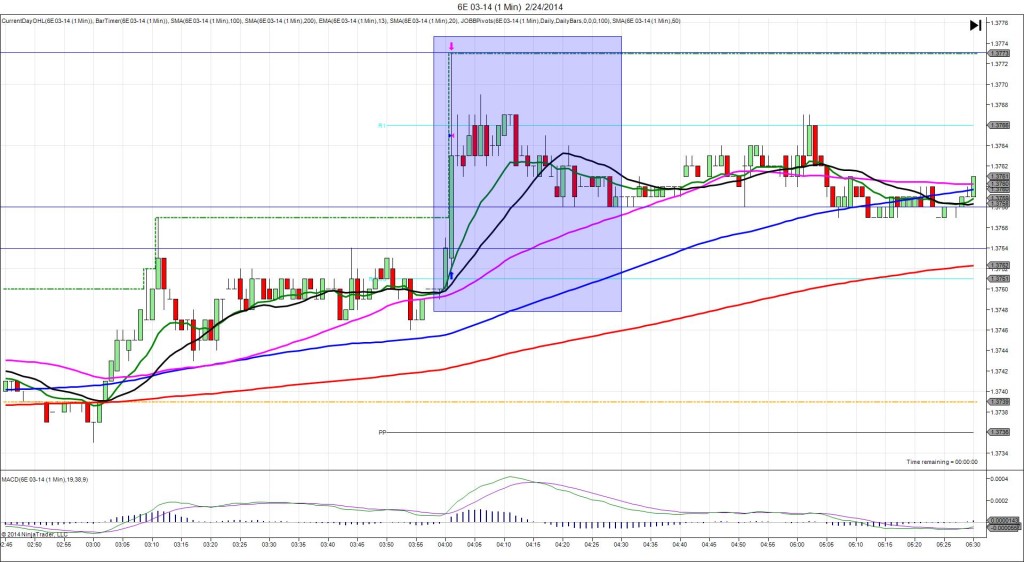

3/25/2014 German IFO Business Climate (0500 EDT)

Forecast: 110.9

Actual: 110.7

Previous Revision: n/a

SPIKE WITH 2ND PEAK

Started @ 1.3828

1st Peak @ 1.3814 – 0500:13 (1 min)

14 ticks

Reversal to 1.3835 – 0500:33 (1 min)

21 ticks

Extended Reversal to 1.3845 – 0512 (12 min)

31 ticks

2nd Peak @ 1.3803 – 0551 (51 min)

25 ticks

Reversal to 1.3816 – 0633 (93 min)

13 ticks

Notes: The reading came in only 0.2 points below the forecast to nearly match and continues to remain at top of the range of readings in multiple years. This caused a small and shortly lived spike of 14 ticks that reversed after 13 sec into the bar after crossing the PP Pivot and extending the LOD. With JOBB, you would have filled short at about 1.3822 with 2 ticks of slippage, then had an opportunity to capture up to 7 ticks with a profit target. If you did not have a profit target, look for a quick exit after hearing the near matching results for 2-5 ticks. It reversed for 21 ticks in the next 20 sec up to 50/100 SMAs, then continued for another 10 ticks in the next 11 min up to the HOD. Then it fell for a surprising 2nd peak of 11 ticks more than the original spike, losing steam just above the S1 Mid Pivot in about 40 min. After that it reversed for 13 ticks in the next 42 min, crossing the 50 SMA and nearly reaching the 100 SMA.