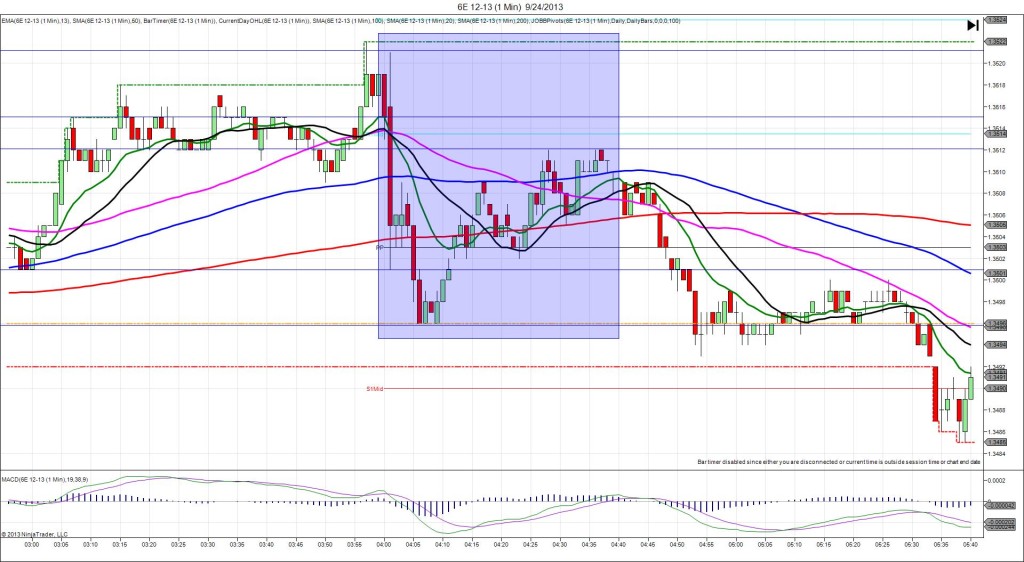

11/22/2013 German IFO Business Climate (0400 EST)

Forecast: 107.9

Actual: 109.3

Previous Revision: n/a

SPIKE/REVERSE

Started @ 1.3495

1st Peak @ 1.3529 – 0402 (2 min)

34 ticks

Reversal to 1.3512 – 0405 (5 min)

17 ticks

Notes: The reading came in 1.4 points above the forecast and the highest reading in multiple years. This caused a large decisive and stable spike of 34 ticks that peaked early on the :02 bar as it reached the R2 Mid Pivot. With JOBB, you would have filled long at about 1.3502 with 2 ticks of slippage, then had an opportunity to capture at least 20 ticks with ease or more if you waited into the :02 bar. After the peak, it reversed for 17 ticks in 3 min back to the R1 Pivot. After that it traded sideways for at least an hour, using the R1 Pivot as its floor.