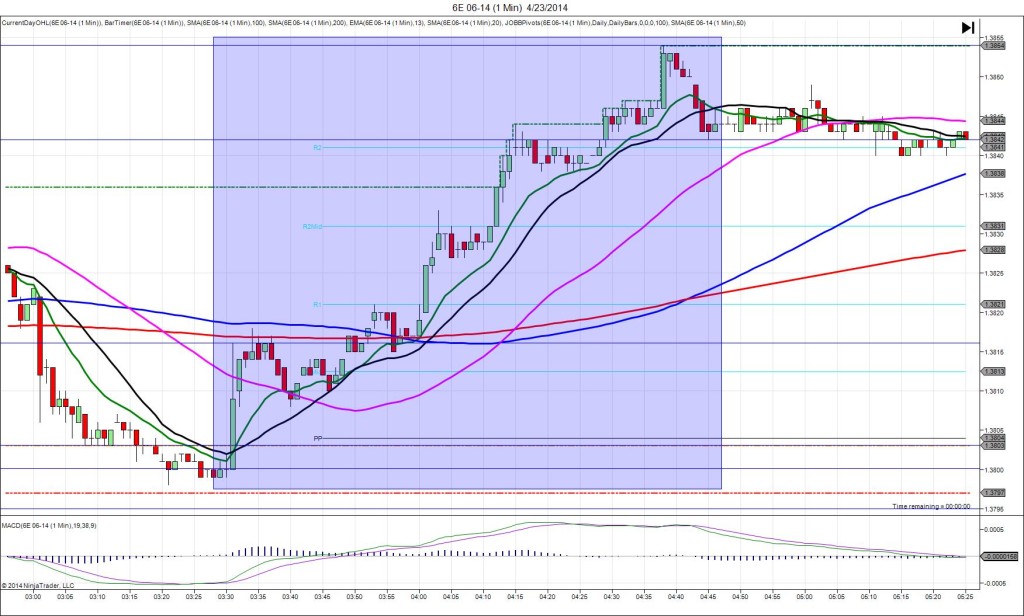

2/20/2014 German Flash Manufacturing PMI (0330 EST)

Forecast: 56.4

Actual: 54.7

Previous Revision: +0.2 to 56.5

Services PMI

Forecast: 53.4

Actual: 55.4

Previous Revision: -0.5 to 53.1

SPIKE / REVERSE

Started @ 1.3705 (0328)

1st Peak @ 1.3680 – 0329 (1 min)

25 ticks

Reversal to 1.3709 – 0345 (17 min)

29 ticks

Notes: Report breaks 2 min early at 0328. The manufacturing reading came in 1.7 points below the forecast to disappoint with a negligible upward revision on the previous report while the services reading came in 2.0 points above the forecast with a modest downward previous report revision to cause a healthy spike that was unsustainable due the conflicted results. This resulted in a 25 tick short move as the manufacturing reading dominated that started on the S2 Pivot and fell to cross the S3 Mid Pivot on the :29 bar. With JOBB you would have filled short at about 1.3700 with 2 ticks of slippage, then a target of up to 19 ticks would filled instantly. After it fell to 1.3680, it retreated to hover in between 1.3685 and 1.3690 before retreating further 17 sec into the bar. This is a case where you have the S3 Mid Pivot at 1.3684 and conflicting news, so move the profit target to about 1.3687 if not filled already to exit with about 13 ticks. After the :29 bar, it continued to slowly pullback long for the next 16 min to the 50 SMA for a total of 29 ticks. After that it fell in a failed attempt at a 2nd peak for only 15 ticks, hitting a low as the EURO-zone readings came in disappointing.