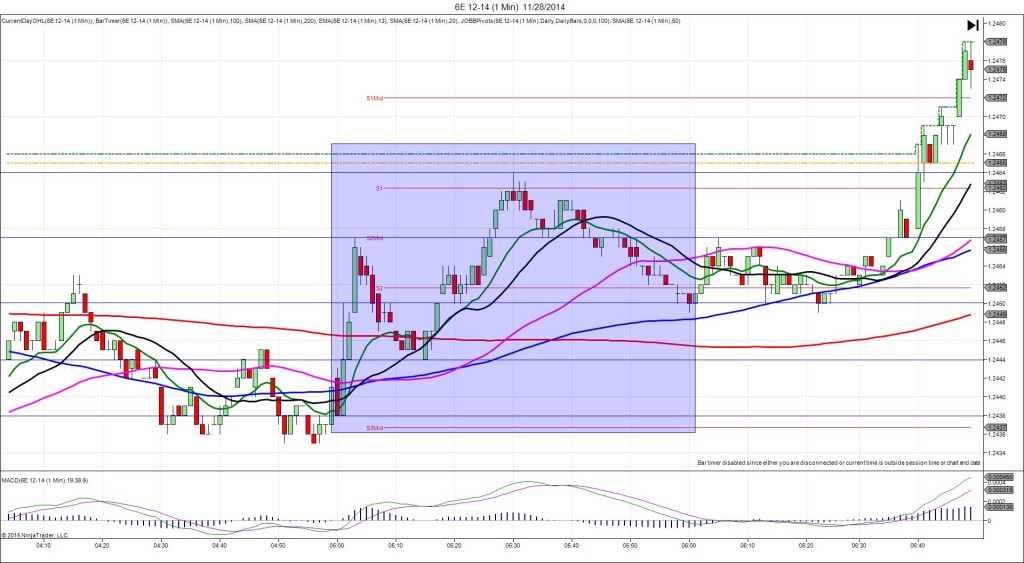

11/20/2014 French Flash Manufacturing PMI (0300 EST)

Forecast: 48.9

Actual: 47.6

Previous Revision: +1.2 to 48.5

Services PMI

Forecast: 48.6

Actual: 48.8

Previous Revision: +0.2 to 48.3

INDECISIVE

Started @ 1.2540

1st Peak @ 1.2535 – 0300:00 (1 min)

-5 ticks

Reversal to 1.2542 – 0300:01 (1 min)

7 ticks

Continued Reversal to 1.2560 – 0303 (3 min)

25 ticks

Pullback to 1.2550 – 0308 (8 min)

10 ticks

Reversal to 1.2577 – 0318 (18 min)

27 ticks

Pullback to 1.2565 – 0327 (27 min)

12 ticks

Notes: The manufacturing reading came in 1.3 points below the forecast to disappoint the market with a strong upward revision on the previous report, and the simultaneous Services reading came in nearly matching the forecast with a small upward revision. This caused a small whipsaw of 7 ticks span in the first second as the revision and result of the manufacturing data conflicted. With JOBB you would have filled short at about 1.2536 with 1 tick of slippage then stopped out at 1.2541 for a 5 tick loss. After the initial volatility, it traded sideways in a dull manner for the rest of the bar then reversed strongly for 25 ticks in 2 min to the PP Pivot. After a 10 tick pullback to the OOD in 5 min, it reversed 27 ticks to the R1 Mid Pivot in 10 min. Then it pulled back 12 ticks in 9 min to the 20 SMA as it headed into the release of the German report at the bottom of the hour.