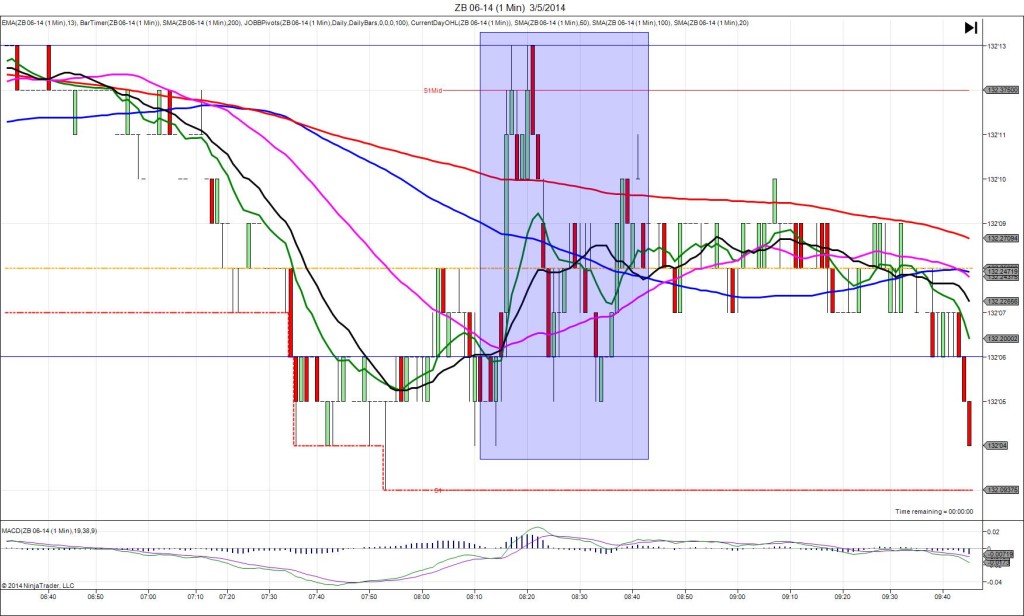

3/5/2014 ADP Non-Farm Employment Change (0815 EST)

Forecast: 159K

Actual: 139K

Previous revision: -48K to 127K

SPIKE / REVERSE

Started @ 132’06

1st Peak @ 132’13 – 0817 (2 min)

7 ticks

Reversal to 132’05 – 0825 (10 min)

8 ticks

Notes: Report mildly fell short of the forecast by 20K jobs along with a large 48K downward revision to the previous report. This caused a smaller long reaction that started on the 50 SMA and crossed the 100/200 SMAs, the OOD, and collided with the S1 Mid Pivot for 7 ticks on the : bar. With JOBB, you would have filled long at about 132’10 with 1 tick slippage, then seen it hover between the 200 SMA and S1 Mid Pivot. The prudent exit would have been at 132’12 with 2 ticks on the S1 Mid Pivot after seeing the hovering. After the :01 bar, it continued to hover above the 200 SMA for 5 more min before falling back to the origin on the reversal on the next 3 bars.